Sage 50 Workaround – Version 26 and below

Sage 50 Workaround – Version 26 and below

If you have not upgraded to Sage 50 version 27.1 you can use the workaround for versions 26 and below . To set up your accounts to allow for the workaround you need to do the following:

1. Enter all transactions up to December 2020

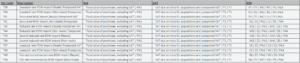

2. Set up Tax codes for Postponed Accounting –

You can download the list of new tax codes from here.

3. Set up new accounts for

- Postponed Customer

- Postponed Supplier

- Postponed Bank

Click here for more information on how to set up new accounts

4. Settings – Countries and Untick UK as EU

- NI Vat codes – Enter in GB/XI before NI supplier and customer vat code

- GB/XI – VAT number

If you are trading under the NI protocol then you must amend your own vat number to put GB/XI in front of it. This can be done in Company Setup.

In version 26 and above its in Settings – Company Preferences and you have a box for EORI number.

Versions 25 and below has no specified field and you must choose an unused field.

Layouts will need to be amended to include your EORI number.

Layouts will need to be amended to include your Commodity codes.

8. Customers and Suppliers in the UK to have a default tax code for postponed accounting to T40

9. Incomplete orders and invoices/credits – change tax codes to include.

10. Processing in Sage 50

Net + VAT – Goods and import VAT

11. You cannot submit the xml file for RTD and VIES directly