COVID 19 – Payroll Related, Coronavirus Information.

COVID 19 – Payroll Related, Coronavirus Information.

As the current situation in Ireland is an ever changing landscape, details in this is article are subject to change. We will endeavour to keep it as up-to-date as possible. Any external links presented below are live, and you can click on them to go through to the relevant site, to help to confirm some of your queries.

This article relates to the initial “Transitional Phase” of the Temporary Wage Subsidy Scheme, for the latest information we have on the “Operational Phase” of this scheme, please click here –> Sage Payroll Software Update 23.2 for Operational Phase of the Covid19 TWSS (4th May 2020 Onwards)

We must advise that if you need clarity on particulars of your business relating to the wage subsidy scheme, you will need to contact revenue before you seek assistance with your payroll software. See Revenue contact details here –> Revenue Contact Us Link. If you are a Twitter user, you can follow them using the handle @RevenueIE –> Revenue Twitter Link

On 15 March 2020, the Government announced the implementation of exceptional measures, administered through the Department of Employment Affairs and Social Protection (DEASP), to enable workers who are temporarily laid off due to the COVID-19 (Coronavirus) pandemic to claim a special support payment called COVID 19 Pandemic Unemployment Payment. The payment was refundable under a scheme called COVID-19 Employer Refund Scheme. On the 24th March 2020, the Government changed this. They retracted the ‘COVID-19 Employer Refund Scheme’, and replaced it with the ‘Temporary COVID-19 Wage Subsidy Scheme’. Alongside that, the government also set up a ‘COVID 19 – Enhanced Illness Benefit’, claimable by those who are directed by a doctor to self isolate or by those who are ill with the virus.

The items covered in this article are:

- Information on ‘Temporary COVID-19 Wage Subsidy Scheme’.

- Information on ‘COVID 19 Pandemic Unemployment Payment‘.

- Information on ‘COVID 19 – Enhanced Illness Benefit’.

- Different Scenarios Employees might find themselves in.

- How to Process Wages for the ‘Temporary COVID-19 Wage Subsidy Scheme’ in Sage Payroll.

- Frequently Asked Questions (FAQ).

1. Information on ‘Temporary COVID-19 Wage Subsidy Scheme’ (Max €410 Weekly)

*This goes through your payroll system, and so it effects your payroll processing.

- This a scheme which allow employers to pay their employees during the current pandemic.

- It applies from Thursday 26th March 2020 onwards.

- Employers will be refunded up to 70% of an employee’s wages – up to a level of €410.

- The employer is expected to make their best efforts to maintain as close to 100% of normal income as possible for the subsidised period.

- It replaces the DEASP’s ‘COVID-19 Employer Refund Scheme‘ which was announced on 15th March 2020.

- Employers who registered for the ‘COVID-19 Employer Refund Scheme’ do not have to re-register for this new scheme.

- It now applies where the employee has been laid off temporarily (zero hours).

- A Top-Up payment is allowed to be paid by the employer.

- It does not apply to workers who have been let go on a permanent basis – they instead qualify for the ‘COVID-19 Pandemic Unemployment Payment’ (see Below)

- Under this Wage Subsidy Scheme, the employee does not need to do anything – but the employer must register to take part in the scheme.

- This goes through your payroll system, and so it effects your payroll processing.

While some more detailed questions remain unanswered, we recommend to both read the articles in the links below, and talk to your accountant/HR contact before proceeding:

Click here to read GOV.ie article with further details –> Gov.ie Link

Click here to read Revenue.ie article with further details –> Revenue.ie Link

2. Information on ‘COVID 19 Pandemic Unemployment Payment’ (Currently €350 Weekly)

*This payment does not go through your payroll system, and so it does not effect your payroll processing.

- This is a special Support Payment introduced due to the COVID 19 Pandemic, it is not an Illness Benefit.

- It is claimable by both employees and self-employed who have been permanently laid off as a direct result of the COVID-19 (Coronavirus) pandemic. (ie: They have lost their jobs).

- This payment will be in place for the duration of the pandemic.

- It is paid at a flat rate of €350 per week (This was increased from €203 to €350 on the 24th March 2020).

- In this scenario, the employee will need to register for the payment directly with the DEASP, and the payment will be made directly to the employee.)

- To get this payment, the employer does not need to do anything – but the employee must register for the payment directly with the DEASP, and the payment will be made directly to the employee.

Again, while some more detailed questions remain unanswered, we recommend to both read the article in the link below, and talk to your accountant/HR contact before proceeding:

Click here to read GOV.ie article with further details –> Gov.ie Link

3. Information on ‘COVID 19 – Enhanced Illness Benefit’ (Currently €305 Weekly)

*Illness Benefit can optionally be put through your payroll system, usually depending on whether the employee is receiving the payment or the Employer.

- This is an Illness Benefit.

- It is claimable by those who are directed by a doctor to self isolate and therefore cannot attend work or by those who are ill with the virus and therefore cannot attend work.

- With regard to payroll, it is treated the same as any illness benefit, the same as illness benefits prior to the COVID 19 Pandemic.

- The Employee applies directly to the DEASP for this, and it is the employee who dictates who receives the payment (themselves or their employer).

- It is not refundable under any scheme.

- The employer cannot apply for this on behalf of the employee.

Again, while some more detailed questions remain unanswered, we recommend to both read the article in the link below, and talk to your accountant/HR contact before proceeding:

Click here to read GOV.ie article with further details –> Gov.ie Link

4. Different Scenarios Employees might find themselves in:

If you are confused about what applies in the different scenarios in which employees are finding themselves in, or you want to better advise employees, Citizens Information have put together this informative article – Citizens Information Link

5. How to Process Wages for the ‘Temporary COVID-19 Wage Subsidy Scheme’ in Sage Payroll

Full Details of processing for the ‘Temporary COVID-19 Wage Subsidy Scheme’ are detailed in the ‘Sage Link’ at the bottom of this section. But before you go there please read the following note:

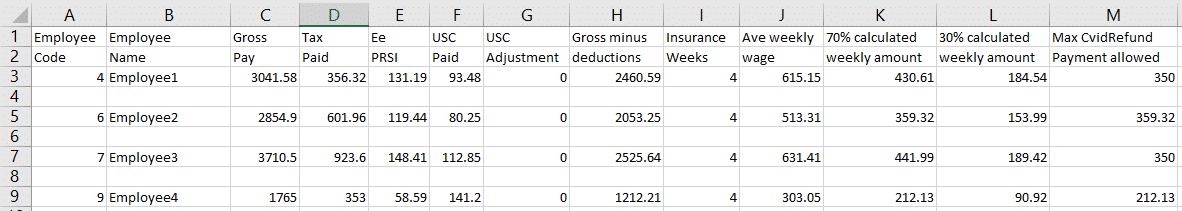

Once you (as an employer) qualify for, and have registered for the Wage Subsidy Scheme with Revenue, the initial part of the process is to calculate 70% of the Average Net Weekly Wage per employee (Averaged over Jan & Feb weeks). You must use this figure from the start of the scheme.

To help you to figure out these amounts per employee, Sage have developed a report for use with the built in Report Writer in Sage Payroll. The article below will guide you through downloading and saving the report file into your system. You can then it run it and print\save it. It is advised to use this report to calculate the amounts, as they are calculated according to Revenues definition of Net Pay.

If you are an ‘ARW’ user (Advanced Report Writer) you will be happy to hear that Sage have developed a suitable report for that too. The article below will guide you through downloading and saving that file to your system. See sample in image below.

**[ARW is a separate program that runs outside of Sage Payroll]

**[We strongly advise that you work through the article below in full, reading each section as there may be particulars in it which lend to decision making during your process.]

Click here for full instructions on how to process the Wage Subsidy in Sage Payroll –> Sage Link

The Sage Report will contain data similar to the image below:

Disclaimer: This article has been provided for information purposes only, While every effort has been made to ensure its accuracy at the time of writing, Pimbrook can not guarantee it will remain fully up to date. We would advise you to seek professional guidance on the latest information before acting on anything related to this topic.