Reconciling values on the Control Summary report

Reconciling values on the Control Summary report

Before you begin processing a new pay period, you should check the values on your Control Summary report are correct. This involves reconciling the carried forward values from the previous period’s report with the brought forward values for the current period’s report.

Generally, the year to date totals for gross pay, tax, universal social charge (USC) and pay related social insurance (PRSI) are the same on both. However, if they’re different, you should always investigate the reasons why and reconcile the differences.

For the current period

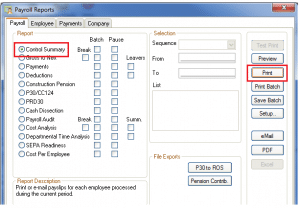

1. On the menu bar, click Reports then Payroll Reports

2. Select Control Summary, then click Print.

3. To close the Payroll Reports window, click Cancel.

For the previous period

-

- 1. On the menu bar, click

Miscellaneous

-

- then

Period Archive

2. Under Period Archives, select the previous period.

3. Click Revert.

4. On the menu bar, click Reports then Payroll Reports.

5. Select Control Summary, then click Print.

6. To close the Payroll Reports window, click Cancel

7. To go back to the current period, click Miscellaneous then Period Archive.

8. Under Period Archives, select Current Period.

9. Click Revert.

To reconcile the values on your Control Summary reports

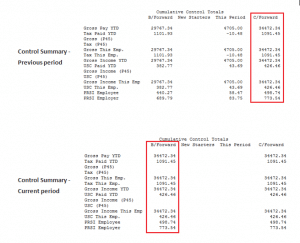

On the Control Summary, the year to date totals appear under the Cumulative Control Totals section. You should review this information and reconcile any differences between the carried forward (C/Forward) values from the previous period and the brought forward (B/Forward) values for the current period.

Possible reasons why your Control Summary values may differ from one period to the next

There are a number of reasons why your Control Summary values may differ from one period to the next. These include:

- If you enter P45 information for an employee who started in a previous period. Micropay no longer considers the employee to be a new starter and their P45 information appears as an adjustment to the brought forward (B/Forward) values on the Control Summary.

If the difference between the brought forward and carried forward values relates to P45 information, there isn’t a problem. However, we recommend that you write a note on the printed Control Summary report to identify the reasons for any differences.

- If you enter P45 information for a new starter, and the new starter is not paid in that period. The P45 information goes into the carried forward (C/Forward) values for that period. In the following period, the new starter’s P45 information remains in the New Starters column and the brought forward (B/Forward) values reduce by the same amount.

If the difference between the brought forward and carried forward values relates to a new starter, there isn’t a problem. However, we recommend that you write a note on the printed Control Summary report to identify the reasons for any differences.

- If you make an amendment to a timesheet, after printing the Control Summary.

- If you manually adjust values on an employee’s record, for example, if you’re setting up an employee mid year and entered their year to date information.

If the difference between the brought forward and carried forward values relates to a legitimate manual adjustment, there isn’t a problem. However, we recommend that you write a note on the printed Control Summary report to identify the reasons for any differences.

In summary, when there is a difference between the brought and carried forward values on the Control Summary, any combination of the above explanations could cause the difference. However, it’s important that you reconcile these differences immediately. You should also write a note on the printed Control Summary report to identify the reasons for any differences.