What is Making Tax Digital for VAT? (MTD)

What is Making Tax Digital for VAT?

As part of their Making Tax Digital (MTD) plans to modernise the tax system, the Government is changing the way VAT registered businesses create and submit VAT Returns.

What does it mean for businesses?

The changes being introduced in April 2019 under Making Tax Digital for VAT are compulsory for businesses that:

• Are VAT registered, and

• Have a taxable turnover above the VAT registration threshold, currently £85,000.

Even if you already submit VAT Returns online from your Sage 50 Accounts, or through the HMRC online services, you will still need to sign up with HMRC and start submitting under MTD.

If your business is affected, we recommend you start preparing soon to ensure a smooth switch to Making Tax Digital for VAT.

Does Making Tax Digital for VAT affect my business?

HMRC has stated that there will be exemptions for some organisations, including:

- Where religious beliefs are incompatible with the regulation requirements.

- Where it isn’t reasonably practicable to use the required digital tools, for example, remoteness of location.

- Businesses subject to an insolvency procedure.

If your business is affected, the new VAT rules apply from 1 April 2019, and you must:

- Ensure you have MTD for VAT compliant software.

- Start maintaining digital business records for the purposes of VAT.

- Sign up with HMRC for MTD for VAT.

- Start submitting your VAT Return through your compliant software.

If you think you may be exempt from MTD, you should contact the HMRC VAT Helpline to make alternative arrangements.

What do I need to do?

Don’t worry, if you currently subscribe to Sage 50cloud Accounts and have v24.2 installed, this is MTD ready.

If you’re still using Sage 50 Accounts, it’s quick and simple to switch your contract to Sage 50cloud Accounts, Contact Gavin on 051-395900 for more details.

HMRC will soon be running an open pilot for MTD for VAT. Once you have your MTD compliant software, we recommend you sign up early. This gives you time to make any required changes to your VAT processes and get used to the new system before it’s mandatory.

Is my Sage 50 Accounts compliant with Making Tax Digital?

Making Tax Digital for VAT becomes mandatory in April 2019. A key change is that from April 2019 HMRC will no longer provide online tools for digital submission of VAT Returns. Instead, submissions must be made through commercial software.

If you currently subscribe to Sage 50cloud Accounts and you have v24.2 installed, this is MTD ready.

Check if you have Sage 50cloud Accounts

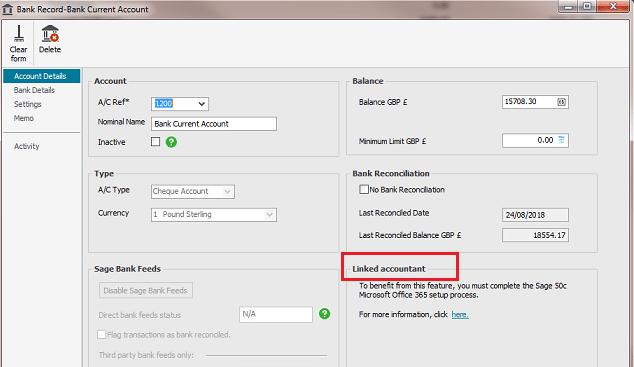

If you’re not sure which software you currently have, to quickly find out if you’re using Sage 50cloud Accounts, check if you can see the Linked accountant option in bank records.

1. Open Sage 50 Accounts.

2. On the menu bar click File, click Open then click Open Demo Data.

3. In Logon name enter manager then click OK.

4. On the navigation bar click Bank accounts.

5. Double-click the default bank account, 1200 – Bank Current Account.

6. In the Account Details tab, check if you can see a Linked accountant section as shown below.

Is making Tax Digital Switched on ?

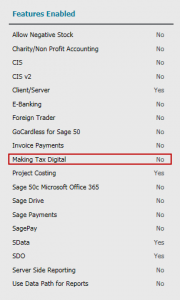

To check if you Accounts has MTD switched on (once you are compatible) you can do this by going into Help – About on your software. Under the heading Features Enabled and Making Tax Digital will say Yes or No.

If its No its not switched and you can switch it on as follows:

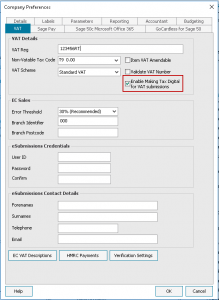

- Click on Settings – Company/Preferences

- Click on the VAT Tab

- Tick the box Enable Making Tax Digital for VAT submissions

Ensure you have the correct information filled in, in the VAT tab.- For more information Click here.

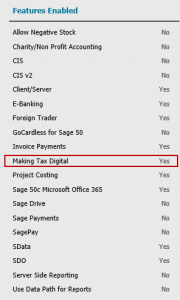

4. Once you go back into Help and About the feature for MTD should now say Yes

Click here for the next steps on Making Tax Digital (MTD)

Find out More

You can find out more from MTD resources

You can find out more about the new rules in HMRC VAT Notice 700/22: Making Tax Digital for VAT.