Boost your productivity and free up valuable time with these three clever Sage 50 tips. By investing just a little time now in familiarising yourself with these areas, you will save a lot of time by automating recurring chores that can eat into your valuable time. It will also mean that you are making the most of your investment in Sage 50 Accounting Software (the latest version of which is known as Sage 50c).

Automate Those Time-Consuming VAT Returns with Sage 50

If you work in any field of commerce, you’ll know that VAT (Value Added Tax) is a tax charged by tax-registered companies on goods and services supplied.

As we write this blog, there are three different rates of VAT charges:

Standard 23%

Reduced 13.5%

Zero 0%

Unless you are operating under the Cash Accounting Scheme, you will pay VAT when you issue an invoice to your customer, or reclaim VAT when a supplier sends you an invoice.

VAT Cash Accounting is slightly different, and means that you only pay VAT to the Revenue when the customer actually pays that invoice you have issued. It allows businesses to protect or utilise VAT for cash flow reasons. In a nutshell, you only become liable for the VAT amount when you actually have it in your bank account.

As a business owner, you are obliged to be compliant at all times, and return the correct details to the Revenue within a specified deadline. Normally, you will be making these VAT return on either a two-monthly or a four-monthly basis.

If a company decides to carry out its VAT computations on a manual basis, not only does it take valuable time, but you are also open to basic human error. It’s amazing how a single error in addition can leave you grossly misrepresenting the amount of VAT due, which may result in your making an unnecessary over-payment, or worse still, under-paying Revenue and possibly leaving yourself open to interest or penalties.

With Sage 50 Accounting Software (Sage 50c), however, all this work is done for you – saving you a huge amount of time and effort. All the relevant transactions are populated into the VAT area of Sage 50 to produce the correct data for your return, and you can send it off to Revenue safe in the knowledge that it is 100% accurate every time.

Not only is this super-fast and super-efficient, but it also means that a simple but costly maths error is completely out of the question.

Sage 50 Accounting Software (Sage 50c) will also cope with transactions being entered after the cut-off date, so that it is included in the next return. All that reconciling and calculating is done for you, quickly and efficiently and without any input on your part.

And to finish off the entire process for you, it will produce the support reports and documents in PDF format. This means that you can save them safely and securely, and can always access them again should you need to through your VAT module in Sage 50 (Sage 50c).

It’s also worth pointing out that Revenue are also pushing all businesses away from paper submissions to online submissions. This obviously makes sense in terms of overall efficiency, and is in keeping with the move to automating everything through the ROS portal.

Sage 50 (Sage 50c) can not only help you to create the file, but will also automatically upload it to ROS on your behalf. It’s fast, it’s slick and it makes your business function that much more professionally.

File your RTD with Sage 50 Accounting Software

Following on from being a VAT registered company, you must also submit an annual Return of Trading Details form to Revenue. Effectively, this represents a summary of all your VAT trading activity.

The return is usually based around the company’s accounting period, and there are strict rules around the deadlines for these returns. It’s a task that could easily be overlooked, leading to potential penalties on the part of Revenue.

Sage 50 Accounting Software (Sage 50c) include rules around calculating these details, and you must ensure your system is set-up accordingly to record the data. Set-up is fairly simple and quick, and once you’ve done it once, you can forget about it thereafter.

Again, once you have this data recorded, it is easily transferred to Revenue via the ROS system. The whole system is fool-proof, and will save you a lot of time and energy, but more importantly than this, it will give you the peace of mind of knowing that your returns have been made on time – and completely accurately.

Bank Reconciliation via Sage 50 Accounting Software

Back in the bad old days, you started with your T-Accounts, balanced the books and then prepared your Bank Reconciliation, starting with your opening bank balance, unpresented items etc. and trying to get back to the closing accounts balance. Not alone was this very time-consuming, but if just a single item had been omitted, it could take you days to find the problem and arrive at a final reconciliation.

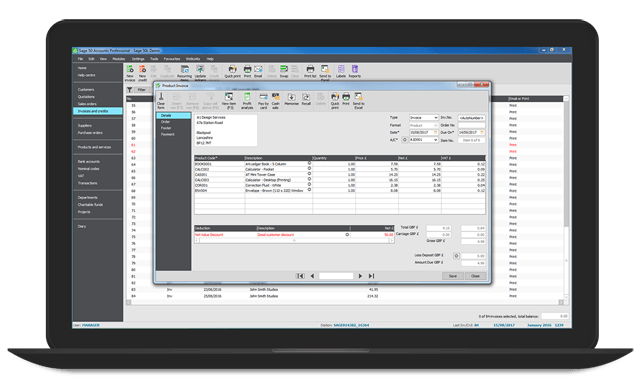

Thankfully, those days are well and truly over. Reconciling in Sage 50 Accounting Software (Sage 50c) couldn’t be simpler. It’s been reduced to just a tick and check exercise.

It boils down to matching your Sage 50 transactions to your bank statement. And you know that if you have paid all your suppliers, and received all your customer payments, you have the correct starting point for the reconciliation.

But what the Sage 50 Bank Reconciliation also points out very quickly to you is any missing transactions – such as bank charges. And to avoid any delay in the entering and reconciling of these items, you can create the charge while completing the Sage 50 reconciliation.

When it comes to the next reconciliation, all the items that have been previously reconciled are cleared from the list, and your last reconciled balance is brought forward. All the reconciled and unreconciled items can be saved and ready for any audit.

So there you have it – three simple ways to save time and energy – and increase your level of accuracy. So what are you waiting for – get cracking with Sage 50 Accounting Software, now known as Sage 50c.

Sage 50 Accounting Software can save valuable time and increase your productivity.

If you have any questions or specific requirements Email us now! or Call us on Tel: 051 395900