Allow Tax Agents to record their Agent TAIN (Required for PAYE Modernisation returns) (v21.1)

Allow Tax Agents to record their Agent TAIN (Required for PAYE Modernisation returns)

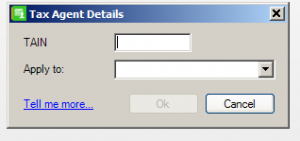

If you’re a tax agent running a payroll on behalf of an employer, you must enter your Tax Advisor Identification Number (TAIN) in Sage Payroll. This is a requirement for PAYE Modernisation returns to Revenue in 2019.

Before you begin, check your version is 21.1 or higher. You can find this in the top left-hand corner of your software. If it’s not, please install the latest Sage Payroll (Micropay) update now.

To apply the same TAIN to all companies set up in Sage Payroll

1. Open Sage Payroll and log into a payroll as normal.

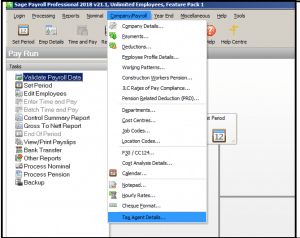

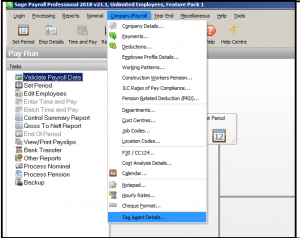

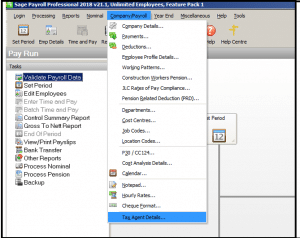

2. On the menu bar, click Company/Payroll then click Tax Agent Details.

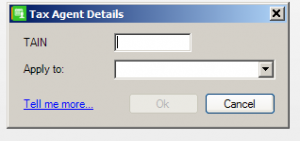

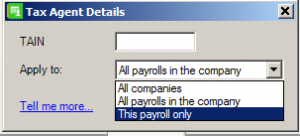

3. In the TAIN box, enter the tax advisor identification number assigned to you by Revenue.

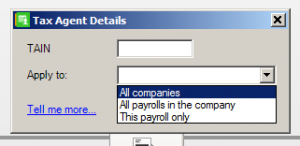

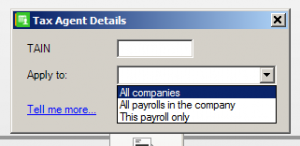

4. From the Apply to drop-down list, click All companies. Then click Ok.

5. When asked if you wish to continue, click Yes to save the changes. Alternatively, if you want to return to the previous window and make further changes, click No then repeat steps 3 and 4.

6. Enter the Sage Payroll administrator password, then click Continue.

7. When prompted that the process has completed successfully, click OK.

To apply the same TAIN to all payrolls associated with this company

1. Open Sage Payroll and log into a payroll as normal.

2. On the menu bar, click Company/Payroll then click Tax Agent Details.

3. In the TAIN box, enter the tax advisor identification number assigned to you by Revenue.

4. From the Apply to drop-down list, click All payrolls in the company. Then click Ok.

5. When asked if you wish to continue, click Yes to save the changes. Alternatively, if you want to return to the previous window and make further changes, click No then repeat steps 3 and 4.

6. When prompted that the process has completed successfully, click OK.

To only apply the TAIN to the payroll you’re currently logged into

1. On the menu bar, click Company/Payroll then click Tax Agent Details.

2. In the TAIN box, enter the tax advisor identification number assigned to you by Revenue.

3. From the Apply to drop-down list, click This payroll only. Then click Ok.

4. When asked if you wish to continue, click Yes to save the changes. Alternatively, if you want to return to the previous window and make further changes, click No then repeat steps 2 and 3.

5. When prompted that the process has completed successfully, click OK.

Click here to view the new features in V21.1