Bike to Work Scheme

Bike to Work Scheme

- As an employer, you can purchase bikes and accessories up to €1000 tax free for your employees and deduct the net cost from their wages over an agreed timeframe.

- This is beneficial to your employees as they receive the full benefit of tax, universal social charge (USC) and social insurance (PRSI) relief on these amounts.

- Your company also pays less employer PRSI on these amounts.

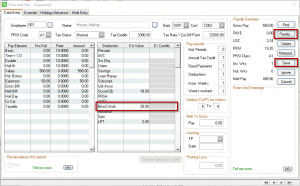

1. To Set up a Bike to Work Deduction

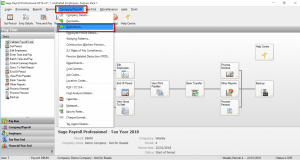

a) At Start of Period – Click Company/Payroll then Deductions.

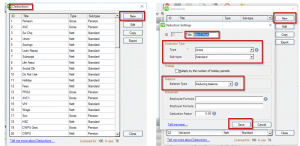

b) Click New & complete the following information:

- Title: Enter a name for the deduction, for example, Bike2Work.

- Type: Click Gross.

- Sub-Type: Click Standard

- Multiply by the number of holiday periods:

(If you want the value of this deduction to adjust according to the number of holiday periods you enter on an employee’s timesheet, select this check box. This option is only available in weekly and fortnightly payrolls.)

- Balance Type: Click Reducing balance.

(This determines how the information will appear on the employee’s timesheet entry)

- Click Save, then click Close.

2. Assign the deduction to an Employee

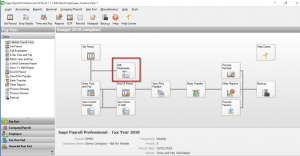

a) Click Edit Employees – Open the relevant employee record and open the deductions tab

b) Locate the Bike2 Work deduction, then enter the following information on the same entry line:

Std. E’e Amt: Enter the amount you want to deduct from the employee each pay period.

Balance E’e: Enter the total amount of the deduction (i.e.: the total cost of the bike)

c) Click Save, then click Cancel.

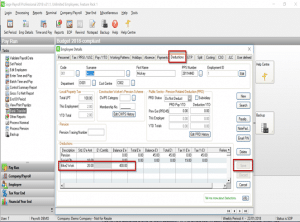

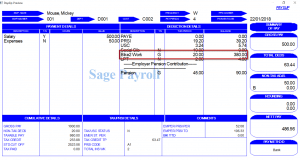

3. Enter Time and Pay,

a) Open the employee’s timesheet, enter the employees payments and you will see on the deductions side, that the standard deduction amount is there for the Bike2 Work.

b) Click Save.

- To check that the set-up is correct you can then click on Payslip to see the details on the timesheet.

- The Bike 2 Work deduction is showing the standard amount deducted this period

- (E20.00 & the reduced balance of E380)

- From now on in each pay period, when you process the employee’s pay details, the deduction balance reduces by the standard amount.

- When it reaches zero, the deduction stops automatically.