Enhanced Reporting Requirements (ERR) to Revenue

Enhanced Reporting Requirements (ERR) to Revenue

The Finance Act 2022 introduced Section 897C which will require employers to report details of certain expenses and benefits made to employees and directors. Reporting the details of these expenses and benefits will commence on 01 January 2024.

The 3 categories of expenses that must be reported are :

1. Small benefit exemption.

2. Remote Working daily allowance and

3. Travel and subsistence which is further broken down into various vouched and un-vouched categories.

Further details of reporting requirements can be found on the revenue website using the link

https://www.revenue.ie/en/tax-professionals/tdm/income-tax-capital-gains-tax-corporation-tax/part-38/38-03-33.pdf

Processing ERR within your Sage Payroll (Micropay)

Sage payroll 2024 V27.0 facilitates the reporting of these payments to revenue from 1st Jan 2024.

To process these payments :

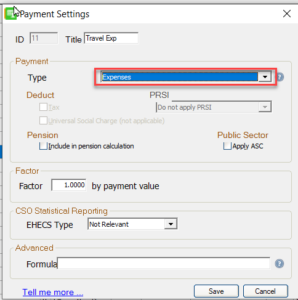

1. Ensure that these payments are made to employees using a pay element with a Type “Expenses” selected.

2. You can set up and use several pay elements for each employee eg. Country Money, Travel Expenses, RWDA (remote working daily allowance), but all must use the Type “Expenses”.

3. Pay employees, end the period and do payroll submission as normal.

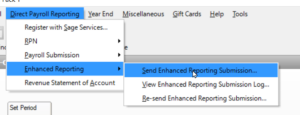

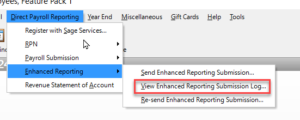

4. Send Enhanced Reporting Submission by selecting icon on desktop or by selecting Direct Payroll Reporting-Enhanced Reporting-Send Enhanced Reporting Submission:

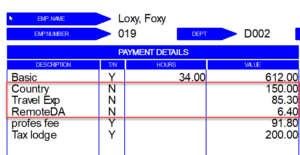

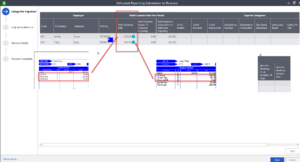

5. You are then presented with this ERR screen below which gives one line for each employee showing a total of all payments made under the payment Type “Expenses”

6. This Total Expenses Paid must then be analysed into the Expense Categories in the columns to the right. This can be manually entered or there will be an import facility available too for those with a larger number of employees.

For further information on importing data to this ERR return, please contact support@pimbrook.ie.

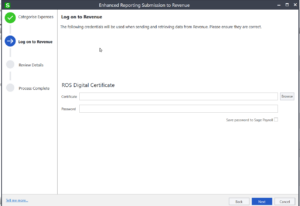

7. Then select Save and Next and this will bring you to the Revenue Log on screen like when doing the usual submission. Check the credentials are correct and then next. You will get a confirmation window and then confirmation of the submission.

8. ERR Submission log will be created and visible in Sage Payroll

9. An ERR report log will be available to print.

You can download a video tutorial on the Enhanced Reporting Requirements Here

You can find additional information on Enhanced Reporting in the links below: