Processing Covid-19 TWSS Reconciliation in Sage Payroll (Sept/Oct 2020)

If you remember back to the TWSS it was rolled out in two phases: The Transitional Phase (26th of March – 3rd of May), and the Operational Phase (4th of May – 31st August).

During the Transitional Phase the employer was expected to calculate the Average Revenue Net Weekly Pay and pay the correct subsidy to the employee via payroll. During this period Revenue refunded employers the maximum subsidy amount of €410 per qualifying payslip, per qualifying employee, per week (or in multiples of this for other pay frequencies). While payroll systems recorded the employees specific TWSS payment amount against a specific payment name, those systems were not yet reporting the exact subsidy amounts back to Revenue via submissions. Things were fast paced back then.

During the Operational Phase, this worked a little differently: Revenue provided employers with the relevant employee information (CSV download) to ensure the correct subsidy amount was paid to each employee, and refunded to the employer on that basis, Payroll systems’ were updated to help decide the exact amount to give to an employee, but also to report back those amounts officially as subsidy amounts, so refunds to employers were from that point more exact.

To tally up the whole thing, Revenue now require employers to carry out a ‘TWSS Reconciliation’. This will be done with the aid of the ‘TWSS Reconciliation’ Feature which came in in Sage Payroll Version 23.3. When you run the feature, it will update the employees ETP records with the actual TWSS values paid to them via nominated Pay Elements in your system. The feature will also create a CSV file, which will list the TWSS payments actually paid to employees during that time. You must then upload the resulting CSV file to the ROS Website to complete your TWSS Reconciliation.

TWSS Reconciliation Upload Window & Penalties:

TWSS Reconciliations must be carried out and uploaded to the ROS website between 21st Sept 2020 – 31st Oct 2020. If you do not provide this data about payments to your employees, Revenue will recoup from you the total temporary wage subsidy paid and related interest charges.

To Process the TWSS Reconciliation in Sage Payroll:

Before you start the TWSS Reconciliation process:

- Ensure your software is at least on version 23.3 of Sage Payroll

- Check the payroll status is Start of Period (SOP) – If its not, the feature will give an error message and will not run.

- Check the Employer registration number is entered in Company Details.

- Ensure a recent payroll backup has been taken to a safe location.

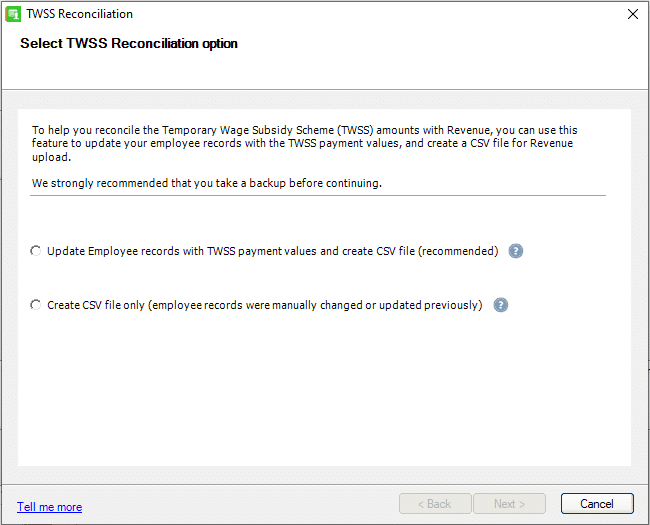

To start the process – at the top of the main screen click on Miscellaneous\Covid-19\TWSS Reconciliation. This will present the TWSS Reconciliation Wizard.

There are two options depending on what stage of the process you are reconciling your values with ROS:

- Update the employee records with TWSS amounts paid during transitional phase, and create a new CSV file (for upload to ROS)

If you use this option in Sage Payroll, the Covid-19 field in the ETP records update, for each relevant employee with the values processed in each period, then creates a CSV file ready for upload to your ROS account. - Create CSV file only, as employee records were manually changed or updated previously by you.

If you use this option in Sage Payroll, it creates a CSV file ready for upload to your ROS account. Use this option if you have previously manually updated the Covid-19 field in the ETP tab for each relevant employee, or completed the Update the employee records and create a new CSV file option already, but now need another copy of the CSV file.

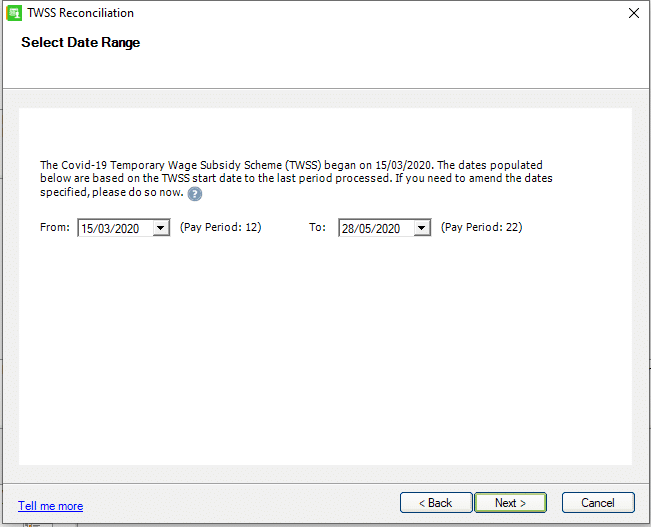

Select Date range used for TWSS subsidy payments:

If you choose the first option, you will be asked to choose a Date Range. The Revenue Covid-19 support schemes (Covid Refund Scheme and TWSS) came into effect from March 15, meaning a date previous to March 15 should not be selected within the reconciliation wizard, but you can do so if required.

Select payments used to process subsidy:

To ensure the correct values are used to update each employee’s ETP record, select the appropriate payments in the list – at least one payment must be selected to proceed in the wizard.

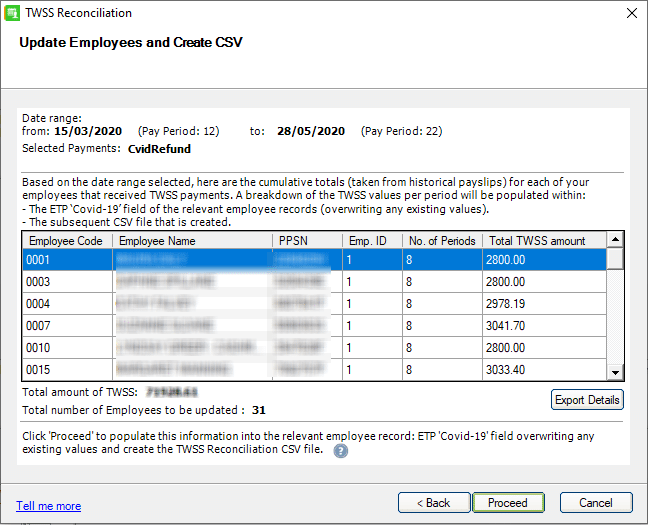

View Employees to Update:

The wizard will present a list of the relevant employees whose ETP records it is about to update:

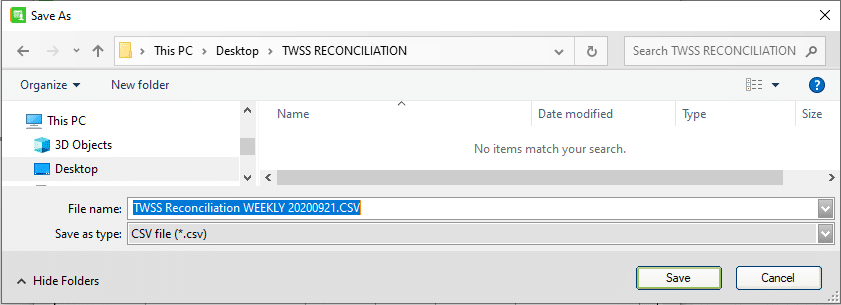

Save Reconciliation CSV File:

The next screen will prompt you to save the file to a chosen location. Make a note of the location as you will need it later when you are uploading the file to ROS.

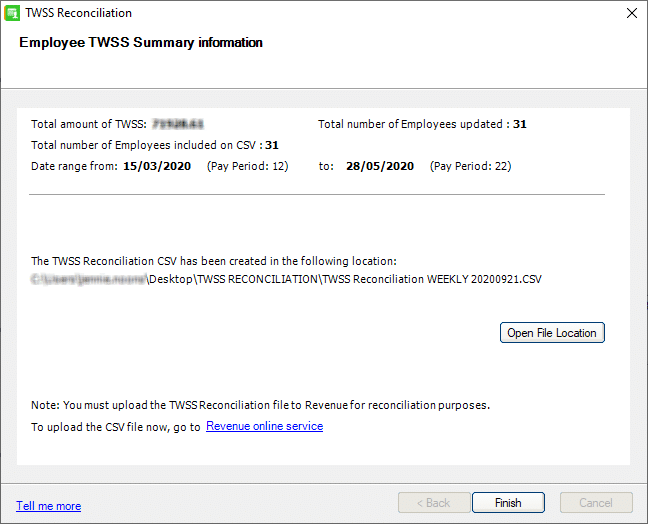

Update Employees & Create CSV File:

Once you click Save, the employee records are updated and the CSV file is created. It is ready for upload to the ROS Website.

Uploading the TWSS Reconciliation CSV File to ROS:

Page 3 of Revenues publication “Instruction on Uploading and Reviewing Subsidy Paid Data via CSV” contains instructions on how to upload the TWSS Reconciliation CSV file to the ROS website.

You can link to the publication here.

More information on the TWSS Reconciliation can also be found at the following links:

- Sage Full Article: “Covid-19 TWSS Reconciliation” –> Click Here

- Dealing with file errors –> Click Here.

- Revenue Website TWSS Reconciliation Info –> Click Here