FAQs – Planning Dates Over Payroll Year End 2022

Here at Pimbrook, we encounter many ‘Date’ queries at Year End time. We have assembled this article to try to take the mystery out of dates at Year End.

See below a list of questions that we frequently get asked:

- What is the ‘Pay Date Rule’?

- What do I need to consider when planning my pay periods at Year End?

- How do I know if I have a Week 53?

- What do I need to consider when planning my New Year Calendar?

- Is it ok to pay my 2021 Period 1, as the final period in my 2020 Payroll System instead?

1. What is the ‘Pay Date Rule’?

- The pay date rule means that if the planned pay date for a period is a 2021 date, then the period belongs in the 2021 payroll and if the planned pay date is a 2022 date, then the period belongs in the 2022 payroll.

- All scenarios are governed by the pay date rule.

2. What do I need to consider when planning my pay periods at Year End?

- For non-monthly frequency payrolls (eg: weekly, 2 weekly etc..), payments to employees should be on the same day every week – including over year end.

- Holiday pay for days taken in 2022 need to be paid using the 2022 payroll. Holiday pay for days taken in 2023 need to be paid using the 2023 payroll.

- If you are planning to run the final periods together [eg: Period 51, 52] – the pay date rule still applies.

- If you have a Period 53 – it must be run separately, and it must have a paydate of 31/12/2021 – Revenue Requirement.

- If you have a Period 53 – Examine the planned pay date for it in your payroll calendar. (Click ‘Company\Payroll’ then click ‘Calendar’ to view it.) If the planned pay date falls in 2022, then it should be included in the 2022 system. The pay date rule still applies.]

- If the planned pay date of the latter period, as seen in your payroll calendar screen, falls in 2022, then it should be included in the 2022 This scenario would then require two separate bank payments, one for payment of the 2021 final period(s) and one for payment of the 2022 period. [In this scenario, you can set the bank file execution date to be the same date if required, but you should contact your bank before doing so, as some banks may interpret two files with the same date as a mistake. Alternatively, you can set different execution dates for the two bank files.]

- All of the above is irrespective of when the work was carried out.

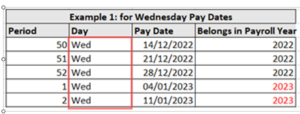

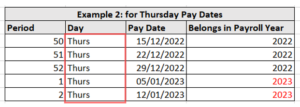

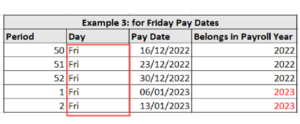

See below Examples of Acceptable Year End 2020/Year Start 2021 Dates:

There were 52 Mondays in 2020, 52 Tuesdays in 2020, 52 Wednesdays in 2020, 52 Thursdays in 2020, and 52 Fridays in 2020. The most popular pay dates would generally be Wed, Thurs & Friday. See examples of correct pay dates for those days in the image below. Your payroll may differ of course, but try to stick to the date rules, and plan correctly for 2021.

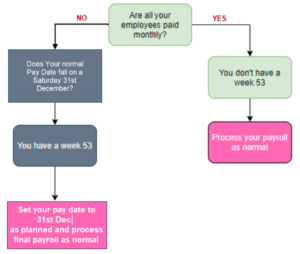

3. How do I know if I have a Week 53?

Because the number of days in the tax year doesn’t divide into a whole number of tax weeks, any remaining days are known as week 53.

- This year (2022), you could only possibly have a week 53 if your Pay Date is on a Sunday or a Thursday, and your final 2020 pay date naturally falls on Wednesday 30th of December or Thursday 31st of December.

- If your first pay date of the year was Wednesday the 2nd or Thrusday 3rd of Jan, then you certainly have a Week 53.

- Remember here that Revenue want employers to pay on the same day of the week, all year round. This includes over year end.

CAUTION: Whilst many employees may already be on week 1 tax status where your company availed of the Temporary Wage Subsidy Scheme, you must process the extra pay period separately to your penultimate pay period.

4. What do I need to consider when planning my New Year Calendar?

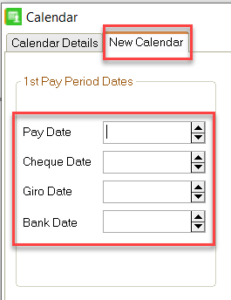

- The Period Date & Pay Date fields are key fields in calendar process.

- The Period Date field has always been in the system and when setting a new calendar, it is driven by the Period Date field.

- Since the Period Date is the systems’ driver when setting up a new Calendar, it’s very important to enter an appropriate ‘Period Date’ for Period 1 of the new tax year, as this date determines all subsequent periods of the calendar.

- The Pay Date field was a new addition in 2019, to accommodate payroll modernisation & submissions.

- The Pay Date refers to ‘the date the employees receive their net pay’. Revenue use this date to determine when you paid your employees.

Revenue do not use the ‘Period Date’ to determine this, as is sometimes assumed.

Revenue do not receive the Period Date in submissions, they only receive the Pay Date. - With regard to the Pay Date: if you’re on a weekly payroll, your first Pay Date should fall between 1 – 7 January. For a fortnightly payroll, it should fall between 1 – 14 January.

We recommend to keep your Period Date the same as your Pay Date, unless you have a specific reason not to. Make sure you have 52/53 planned periods in your new calendar, and that all the Pay Dates are dated in the new year (ie: 2022).

6. Is it ok to pay my 2022 Period 1, as the final period in my 2020 Payroll System instead?

- The short answer is No. Since payroll modernisation came in at the start of 2019, Revenue have been very clear that the do not want you to do this.

- Revenue want employers to pay on the same day every period, so changing the pay-day is not an option.