Setting up a New Monthly Calendar

Setting up a New Monthly Calendar

1. When you log into your 2019 payroll, ensure that your Sage Payroll Version number is the latest Version. ( 2019 Software should be V22.0)

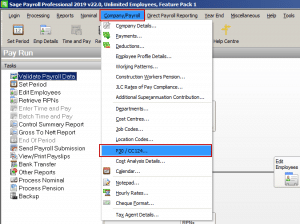

2. Select the Company/Payroll and the Calendar menu option.

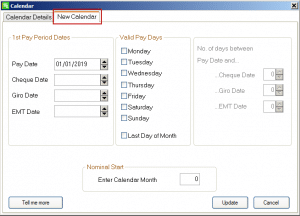

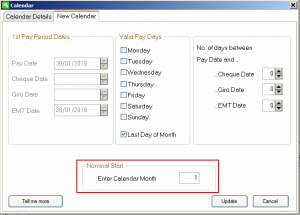

3. In the Calendar window, Click New Calendar tab.

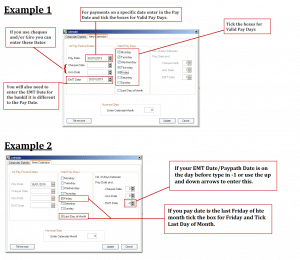

4. Enter the calendar details for Period 1 of the new tax year.

N.B. It’s very important to enter the correct PAY Date for Period 1 of the new tax year. This date determines the subsequent dates of all of the 2019 pay periods.

5. Enter Calendar Month number of the start of your Financial Year.

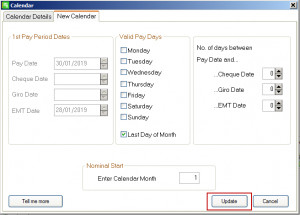

6. When you are happy with the dates entered click on Update.

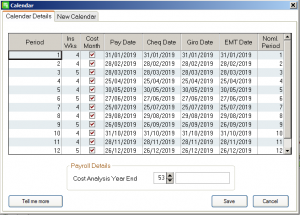

7. This will populate the dates for the full year. You can amend the calendar information if required, and set your cost analysis year end period and then click save.

8. Repeat this procedure for each payroll you set up in 2019 (if you have payrolls with the same frequency and pay date, you can copy the calendar in the Admin Section.