Tax codes in Sage Accounts – Ireland only

Tax codes in Sage Accounts – Ireland only

Sage Accounts calculates VAT using tax codes. Each tax code has a rate associated with it and the VAT calculates based on this rate.To save you time when posting transactions, you can use the default tax codes already set up in your software. You can edit any of these tax codes or you can add your own.

There are 100 tax codes in total, and for each one you can amend the rate and description. You can also specify if it’s an Irish or EU tax code, and choose if you want to include it in your VAT Return.

Before you proceed any further, check that your computer’s regional settings is set to Ireland and not UK. For more information about how to do this, please refer to article 33741.

Sage default tax codes

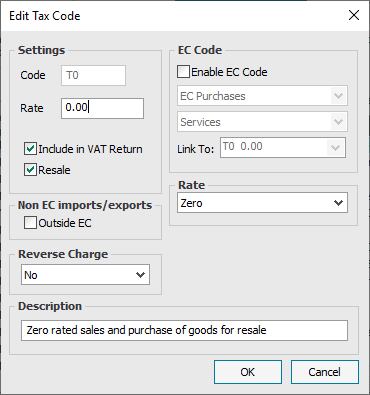

| T0 | Zero rated sales and purchase of goods for resale. |

|

|---|---|---|

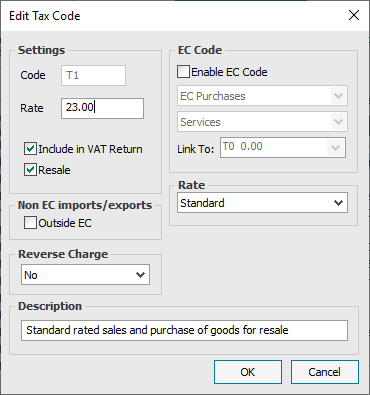

| T1 | Standard rated sales and purchase of goods for resale. Currently 23%. |

|

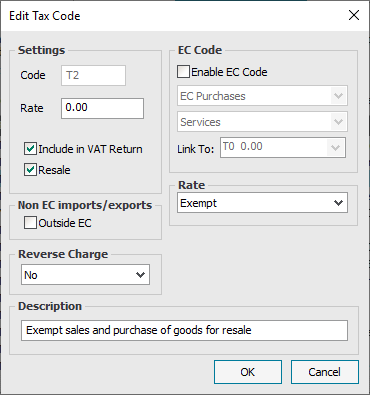

| T2 | Exempt sales and purchase of goods for resale. |

|

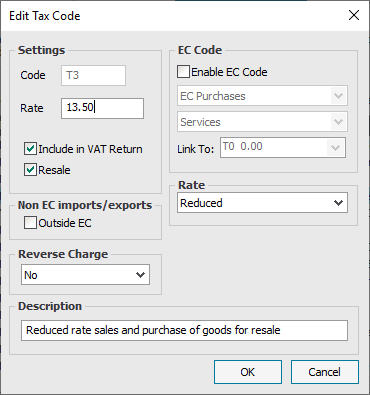

| T3 | Reduced rate sales and purchase of goods for resale. Currently 13.5%. |

|

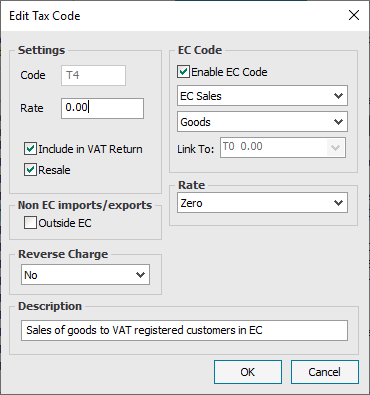

| T4 | Sales of goods to VAT registered customers in EU. |

|

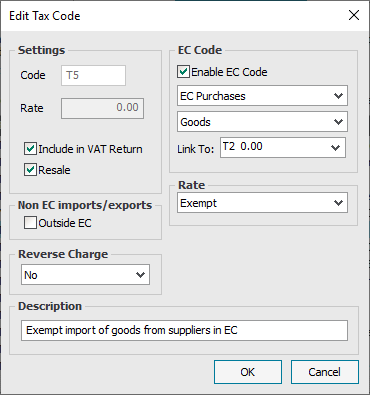

| T5 | Exempt import of goods from suppliers in EU. |  |

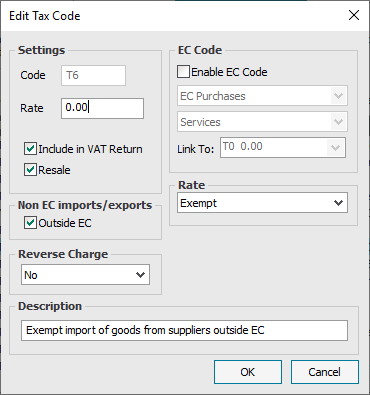

| T6 | Exempt import of goods from suppliers outside EU. |

|

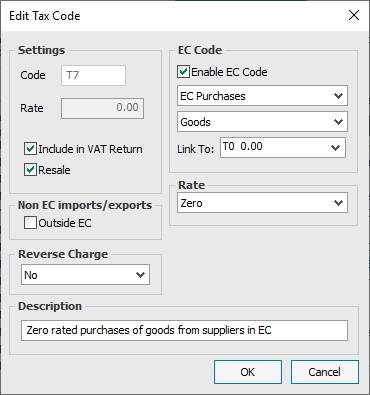

| T7 | Zero rated purchases of goods from suppliers in EU. |

|

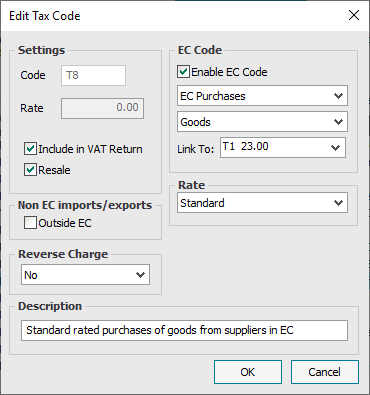

| T8 | Standard rated purchases of goods from suppliers in EU. |

|

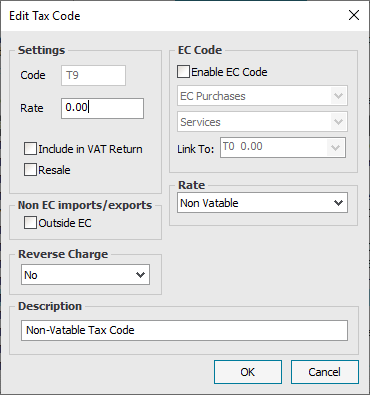

| T9 | Non-vatable tax code.

Note: If you post any transactions with this tax code, they don’t appear on your VAT Return. |

|

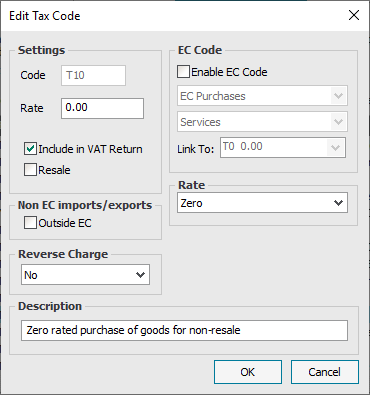

| T10 | Zero rated purchase of goods for non-resale. |

|

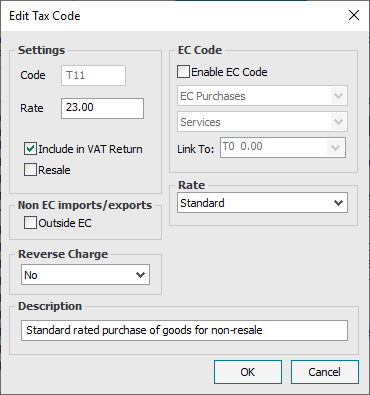

| T11 | Standard rated purchase of goods for non-resale. |

|

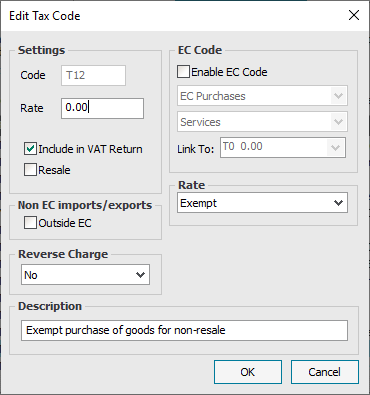

| T12 | Exempt purchase of goods for non-resale. |

|

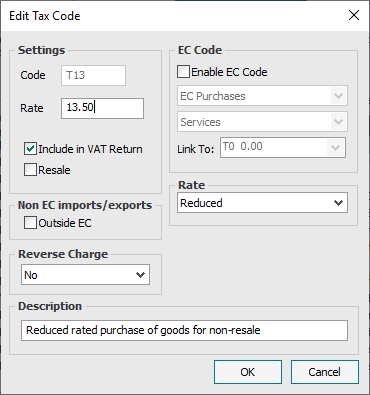

| T13 | Reduced rated purchase of goods for non-resale. |

|

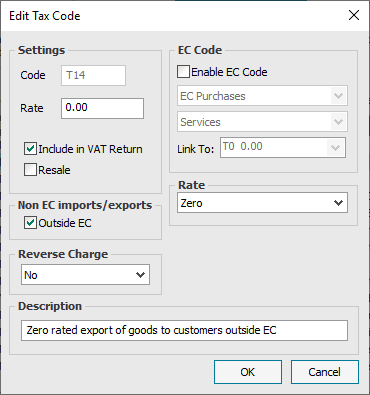

| T14 | Zero rated export of goods to customers outside EU. |

|

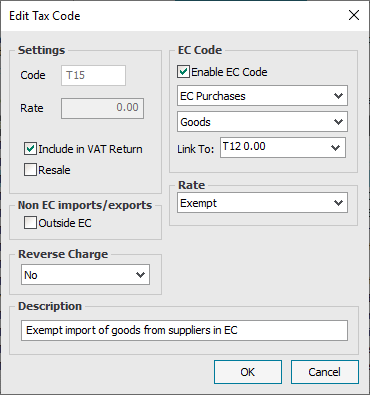

| T15 | Exempt import of goods from suppliers in EU. |

|

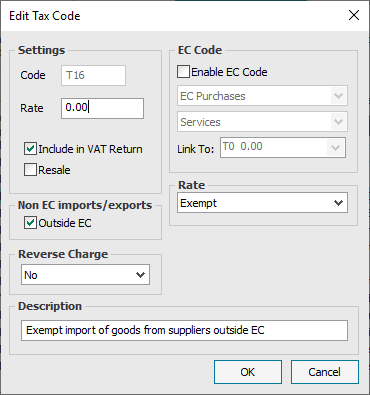

| T16 | Exempt import of goods from suppliers outside EU. |

|

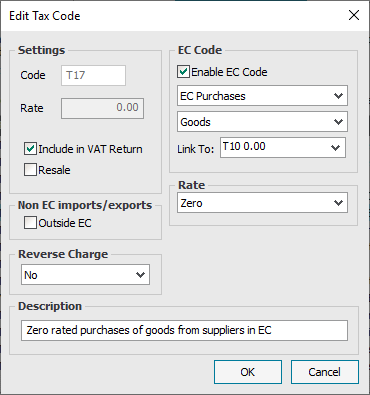

| T17 | Zero rated purchases of goods from suppliers in EU. |

|

| T18 | Standard rated purchases of goods from suppliers in EU. |

|

| T19 | Zero rated purchases of goods from suppliers outside EU. |

|

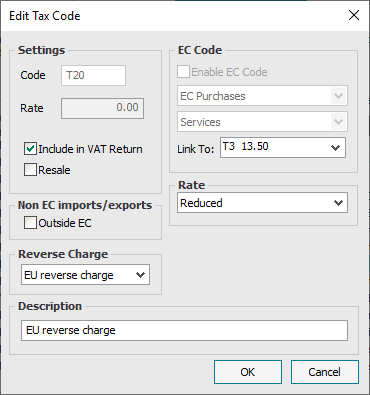

| T20 | Reverse charges. |

|

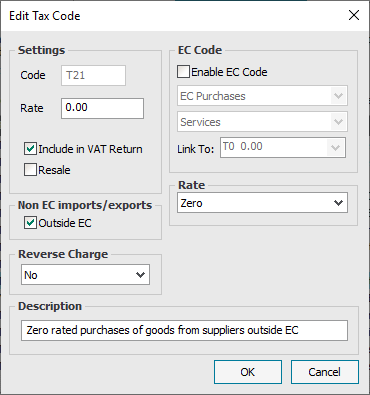

| T21 | Zero rated purchases of goods from suppliers outside EU. |

|

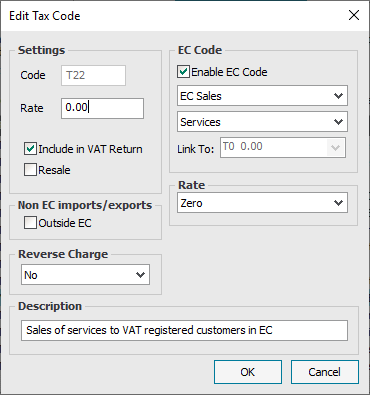

| T22 | Sales of services to VAT registered customers in EU. |

|

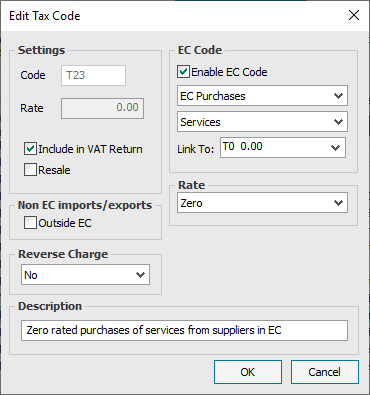

| T23 | Zero rated purchases of services from suppliers in EU. |

|

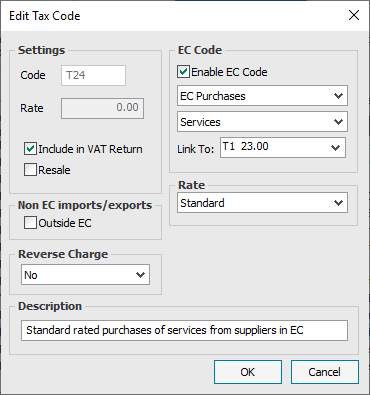

| T24 | Standard rated purchases of services from suppliers in EU. |

|

| T25 | Reduced rated purchases of goods from suppliers in EU. |

|

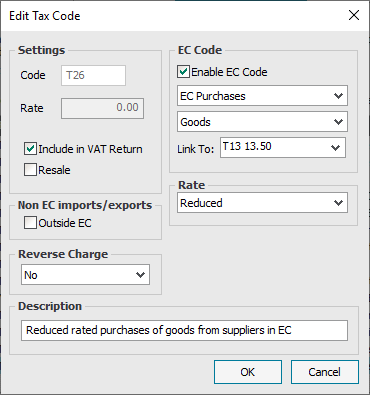

| T26 | Reduced rated purchases of goods from suppliers in EU. |

|

| If you’ve installed the September 2016 Improvements for Sage 50 Accounts, the following additional tax codes are set up by default: | ||

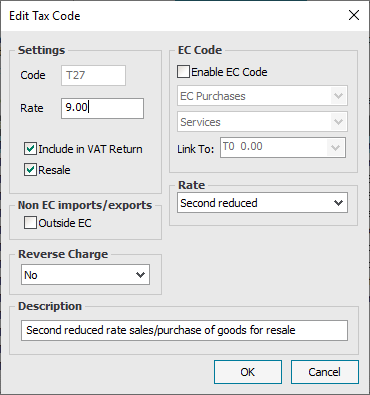

| T27 | Second reduced rate sales/purchase of goods for resale |

|

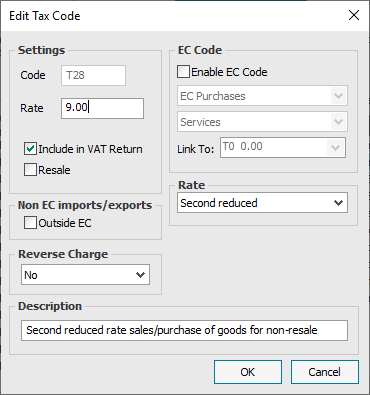

| T28 | Second reduced rate sales/purchase of goods for non-resale |

|

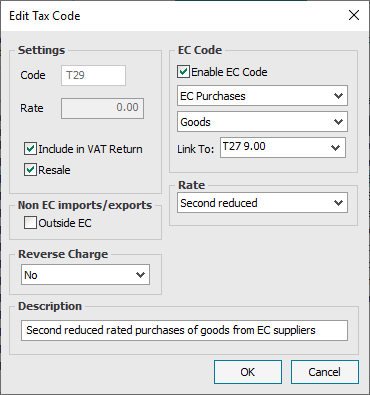

| T29 | Second reduced rated purchases of goods from EC suppliers |

|

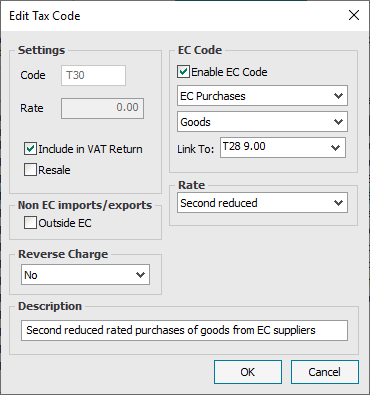

| T30 | Second reduced rated purchases of goods from EC suppliers |

|

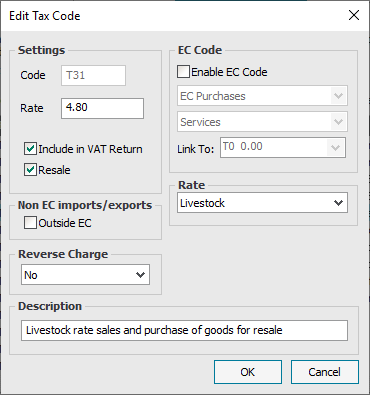

| T31 | Livestock rate sales and purchase of goods for resale |

|

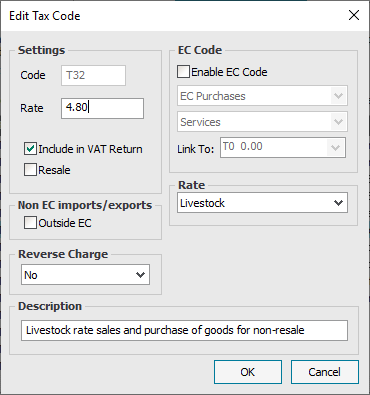

| T32 | Livestock rate sales and purchase of goods for non-resale |

|

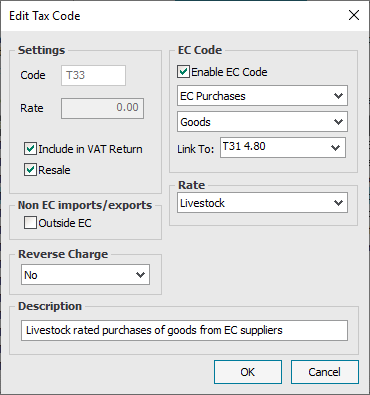

| T33 | Livestock rated purchases of goods from EC suppliers |

|

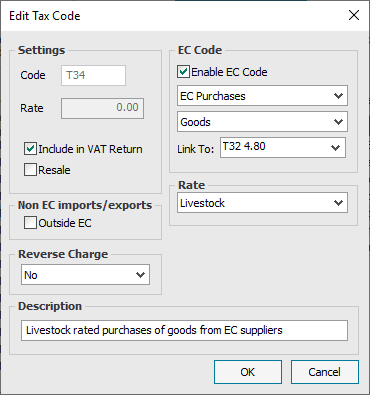

| T34 | Livestock rated purchases of goods from EC suppliers |

|

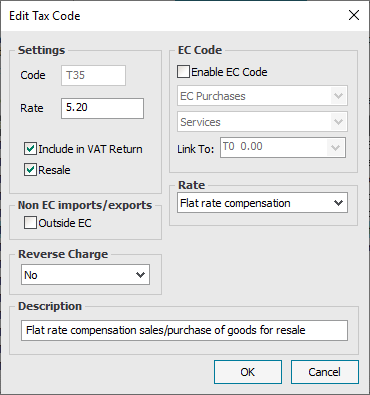

| T35 | Flat rate compensation sales/purchase of goods for resale |

|

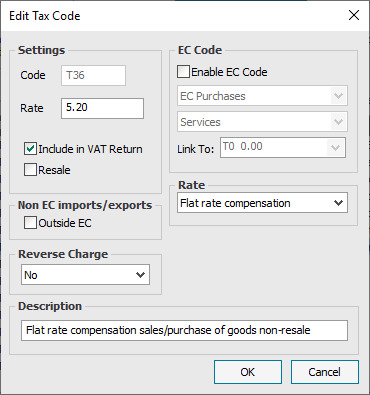

| T36 | Flat rate compensation sales/purchase of goods non-resale |

|

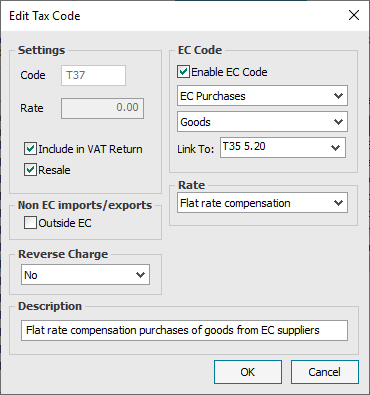

| T37 | Flat rate compensation purchases of goods from EC suppliers |

|

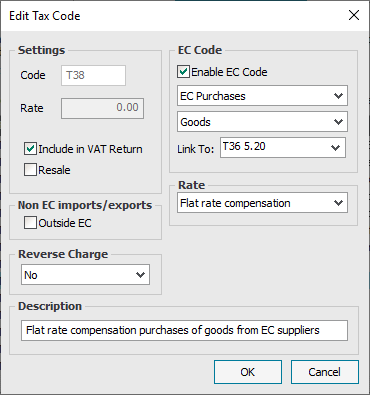

| T38 | Flat rate compensation purchases of goods from EC suppliers |

|

Which boxes the tax codes affect on the VAT Return

Tax code T23 appears correctly on the VAT Return, however we’re currently investigating an issue where T23 transactions appear in the wrong box on the Return of Trading Details (RTD). Read more >

| Tax Code | Sale or Purchase | Net or VAT amount | Box |

|---|---|---|---|

| T0 | Sale | Net | Appears in Total value of sales, excluding VAT box |

| VAT | N/A | ||

| Purchase | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | N/A | ||

| T1 | Sale | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchase | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T2 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | N/A | ||

| Purchase | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | N/A | ||

| T3 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchase | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T4 | Sales | Net | Appears in box E1 and Total value of sales, excluding VAT box |

| VAT | N/A | ||

| T5 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T6 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T7 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T8 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box | ||

| T9 | Non-vatable tax code, doesn’t appear on VAT return. | ||

| T10 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T11 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 | ||

| T12 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T13 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 | ||

| T14 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | N/A | ||

| T15 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T16 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T17 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T18 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box | ||

| T19 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T20 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box | ||

| T21 | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A | ||

| T22 | Sales | Net | Appears in box ES1 and Total value of sales, excluding VAT |

| VAT | N/A | ||

| T23 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | N/A | ||

| T24 | Purchases | Net | Appears in box ES2, Total value of sales, excluding VAT and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box | ||

| T25 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box | ||

| T26 | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box | ||

| T27 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T28 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T29 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

| T30 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

| T31 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T32 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T33 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

| T34 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

| T35 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T36 | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box | ||

| Purchases | Net | Appears in Total value of purchases, excluding VAT box | |

| VAT | Appears in box T2 | ||

| T37 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

| T38 | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions | ||

Popular goods and services and the tax codes to use

| T0 | Zero rated goods and services. |

|

|---|---|---|

| T2 | Exempt goods and services. |

|

| T9 | Non-vatable items. |

|

To create or amend a tax code

- Click Settings, click Configuration, then click Tax Codes.

- Select the required tax code then click Edit.

- Complete the Edit Tax Code window as follows:

| Rate | Enter the required percentage. For example, to set up a 23% VAT rate, enter 23.00.

If you select the Enable EC Code check box, the Rate box isn’t active. |

|---|---|

| Include in VAT return | To include transactions with this tax code on the VAT Return, select this check box. |

| Reverse Charge | To flag sale or purchase items that fall under the remit of carousel fraud, for example, mobile phones, select this check box. Don’t select this for standard reverse charge transactions. |

| Resale | To flag transactions involving purchases for resale, select this check box. |

| Outside EC or Non EC Transactions | To flag transactions that occur outside EU territories, select this check box. |

| Enable EC Code or EC code | If this is an EU tax code, select this check box. Then choose the relevant options from the drop-down lists. |

| Link To | This option is only available for EU purchase tax codes.If you want to use this tax code to record notional VAT, choose the required tax code that you want to link to. Notional VAT calculates based on the rate of the code you link to. |

| Rate | For RTD reporting purposes, select the relevant option. |

| Description | Enter a description for the tax code. |

- Click OK, then click Apply.

- click Close and if you’re prompted to save the changes, click Yes.