Year End Dates & Week 53

Based on discussions at the Payroll User Forum in October 2019, I made the following notes.

They are based on the 2019 Year End / 2020 Year Start, but they apply to any year.

Sage KBA for Covering the topic of Week53:

Sage have produced ASK 32326, which covers the Week53 topic, which is very good.

Revenue Preferences:

- For weekly payrolls, payments to employees should be on the same day every week – including over Christmas.

- Holiday pay for days taken in 2019 need to be paid in the 2019 payroll.

- Holiday pay for days taken in 2020 (ie: 2nd/3rd Jan) need to be paid in the 2020 payroll.

- Where a company are going to run 3 weeks ahead, ie: Period 51, 52 and another one – the pay date rule applies: If the pay date of the 3rd week is in 2019 then it would be a week 53 in the 2019 system. If the pay date of the 3rd week is in 2020 then it would be week 1 in the 2020 system.

- If the company did not plan for 53 pay dates year at the beginning of the year, then they should not be having one.

- It is Revenue’s intention to contact any company who process a period 53.

Pay Date Rule:

The pay date rule basically means that if the pay date is a 2019 date then it belongs in the 2019 payroll and if the pay date is a 2020 date then it belongs in the 2020 payroll.

All scenarios are governed by the pay date rule.

Problem Scenario:

I identified the following to the user panel, which is causing confusing pay date scenario:

When the calendar is set at the start of a payroll year, the software calculates the number of periods based on the Period Date, but based on the prominence of the Pay Date field now, the number of periods in a year should actually be calculated by the Pay Date field. (Sage agreed.)

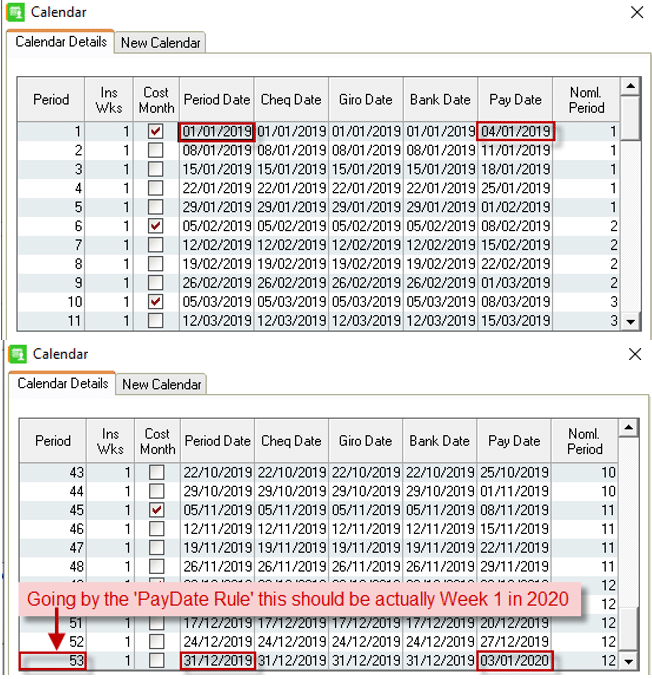

Not having the pay date as the date by which the number of weeks are measured when setting up the calendar, will cause the following problem. This example is of a weekly payroll where the period date is three days before the pay date, on a weekly basis: Period Date: Tuesday 01/01/2019 with Pay Date: Friday 04/01/2019. It seems to be specific to payrolls where the Period 1 had a period date of 01/01/2019.

If the customer has already done 52 weeks in 2019 then it would be ok to suggest to them that the week with suggested paydate in 2020 system (above), should be processed as Week 1 in 2020 to satisfy Revenue. The customer will be tempted to run the period 53 in 2019 and change the pay date of period 53 to be Tue 31st Dec, but as per discussions at the Payroll Forum – revenue prefer if payroll operators would stick to the same day of the week for pay dates. This reason can be used a leverage to steer the customer in the right direction.

In a payroll where the user always sets the period date the same as the pay date, there are no issues.

At the end of the day we can’t control what the payroll operator does, we can only advise them. In all cases, refer the user back to the Pay Date rule, and ‘Revenue Preferences’ above.