Are you ready for the P35 Annual Return?

Make sure you’re fully compliant when it comes to your P35 Annual Return by using Sage Micropay to automate the task. Not only can it save you a fine of up to €5,000, but it also makes sure your employees are protected.

Automate Your P35 Return with Sage Micropay

We’d all love to get on with our primary business – without any interruptions. In the real world, however, the typical business spends much of its time on admin work that’s often not that productive, but simply has to be done.

In the area of compliance, for example, every registered employer is obliged to submit a P35 Annual Return after the end of the tax year. It includes details of everyone the company employed at any time during the tax year.

It can sound like a lot of trouble, but the reality is that you can automate the task via modern payroll software such as Sage Micropay. And by doing so, it not only makes sure that full details of all payments or benefits paid to employees are fully accounted for, but you’ll also avoid some very costly penalties if you fail to pay and file on time.

How to File a P35 Annual Return?

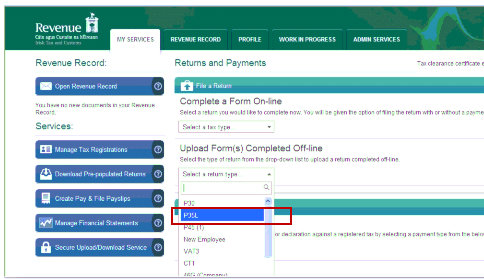

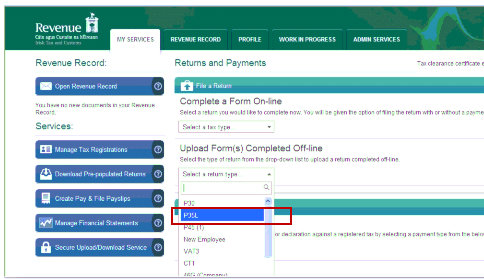

Essentially, there are two methods open to you when it comes to filing your Return. If you’re registered with Revenue’s Online Service (ROS), then this is your simplest way of doing it. You can not only file the Return, you can also pay any balance due. And don’t forget that with Sage Micropay you can upload your P35 electronically (and also file online for manual payrolls).

Under normal circumstances, the Filing deadline is February 15th, but if you pay and file using the ROS system, this is extended to February 23rd. It makes sense, however, to sort this task as soon as possible – it’s then one less chore to take your eye off the prize, and having it completed lets you get on with the rest of the year without this hanging over your head.

The second way to make a Return is via a Paper Return. This option is only available to customers who don’t have access to ROS and who are not mandatory e-filers. Once you’re approved by Revenue to submit Paper Returns, you will receive all the forms you need.

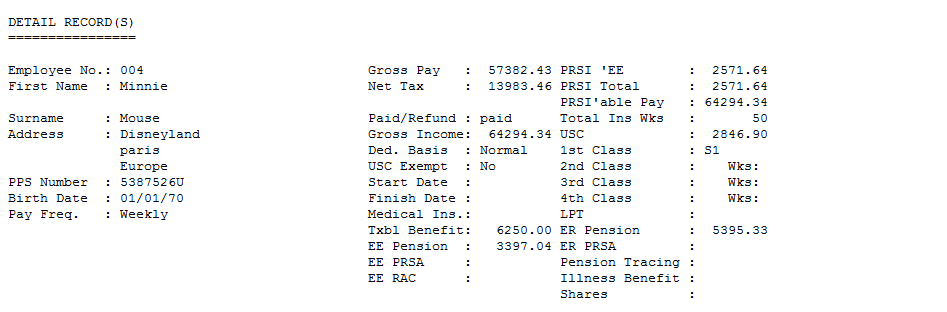

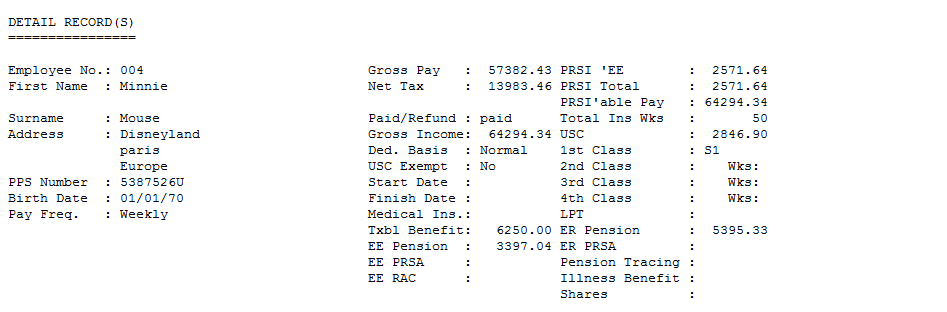

What Employee Details Must be Included?

There are three main areas that must be included;

- Gross Pay & Tax Paid

- Gross Income & Universal Social Charge

- PRSI able Pay & PRSI

Who do you Include on a P35?

First off, it has to include details of all employees during the tax year – regardless of how short a period they may have worked for.

You also need to include Directors, and also any Family Members who may have been employed (for whatever period) during the year in question.

In the case of new employees who joined you during the year, you’re only obliged to record details of their employment with you. Also note that any departing employees need to be included.

Another category to include relates to recurring employment. If, for example, you have employed the same person for three periods of a month, you need to aggregate these periods to create a single record. You also need to include PAYE Exclusion Order employees.

If you did not have any employees during the year and are registered with Revenue as an employer, you need to file a ‘Nil’ P35.

What Benefit Information Goes on a P35?

As well as income details, you are also obliged to include any benefits the employee may have enjoyed.

For example, you must include;

- Illness benefit

- Maternity and paternity benefit

- Employee benefits (such as use of a company car)

- Shares

Making Payments and Claiming Refunds

If you’re going through ROS and file any time after 23rd January, any balancing payment has to be submitted with the P35. If you’re filing before this date, however, the December P30 payment may not be deducted from your account yet. This must be taken into account when calculating any balancing P35 payment that may be due.

P35 overpayments due for refund need to be claimed either on the P35 Annual Return Declaration or in writing. Failure to do so means that a refund or offset will not be processed and you will lose out. ROS filers should claim any overpayment by completing the ‘Total refund amount’ field on the P35 Declaration on ROS, and any valid refunds will be credited in due course to your nominated bank account.

When you are uploading the P35 to ROS it is called a P35L even if it is an amended or supplementary P35.

Amending or Supplementing Your Return

Assuming that you have filed the original P35, you can make adjustments to the details provided by filing either an amended or a supplementary P35.

An amended P35 should be used to revise employee details on a P35L that has already been submitted.

A supplementary P35 must be used, however, when an employee who was omitted from the original P35 is to be added to the overall return

Are There Payments for not Paying and Filing?

Yes there are. A penalty for not filing the P35, up to a maximum of €5,000 can apply. Revenue may also attach interest on late payments. It’s essential that you observe the relevant date and pay on time, but this task can be easily automated via Sage Micropay.