How to track bank reconciliation changes

How to track bank reconciliation changes

A question that can come into support related to bank reconciliation, is that balance on your last reconciled statement is different since you last reconciled.

When reconciling your bank, you are matching your entered transactions in Sage 50 to your physical printed bank statements. Sage handles these

matched transaction by flagging them in the background as being reconciled. It’s these matched transaction that make up your reconciled balance and it’s

this balance that can change. This occurs for a number of reasons such as a bank reconciled transaction is deleted or an in correct transaction was reconciled,

to a reconciled transaction becoming un reconciled.

Prior to version 25.1, you would only realise the difference when you go into your Bank Reconciliation screen and realise that the ‘Last Reconciled Balance’

is different to what you had originally reconciled. When this happened you would have to follow a lenghty process to identify what transaction was causing

the problem.

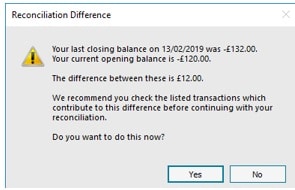

In version v25.1 when you go to enter in your new ‘Ending Balance’ and ‘Statement date’ on the Statement Summary screen’ on clicking ‘Ok’ if there is a

difference you will now get a new ‘Reconciliation Difference’ screen appearing letting you know of the difference.

Click ‘Yes’ on the ‘Reconciliation Difference’ screen to view the transactions.

How to Correct the Difference

1) If the transaction was deleted.

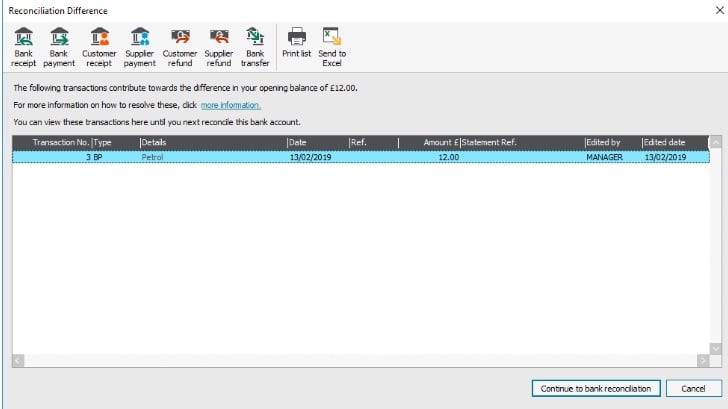

How you proceed depends on what has happened to that transaction, if it was deleted you will need to re enter the transaction. To do this

you can use the buttons at the top of the ‘Reconciliation Difference’ screen, for example if you deleted a Bank Payment (BP) you will select

the icon for ‘Bank Payment’. Make sure that you enter in the exact details of the deleted transaction. Once you click ‘Save’ Sage will automatically match

this transaction on your reconciliation screen.

2) If the transaction had been un-reconciled.

If the transaction was un -reconciled, click ‘Continue to Bank Reconciliation’ button this will take you back to the Bank Reconciliation screen where you

can identify the transaction in the ‘Unmatched’ items list and select it as ‘Matched’ to be re reconciled.

3) If the Transaction was reconciled in error:

Make a note of the transaction number then click ‘Cancel’ on the ‘Reconciliation Difference’ screen. Select the ‘Transaction’ module and location the

transaction in question by looking for the transaction number in the ‘No’ column. Once you find it click on the ‘Edit’ button and untick the ‘Bank Rec.on’ tick box,

click ‘Save’, and select ‘Yes’ and ‘Yes’ again on the following screens. T

Once you have unticked your transaction as being unreconciled it will now appear on your bank ‘Reconciliation’ screen as being unmatched.

(SD)