| Tax Code |

Sale or Purchase |

Net or VAT amount |

Box |

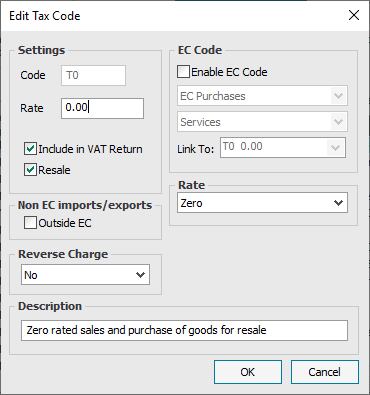

| T0 |

Sale |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

N/A |

| Purchase |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

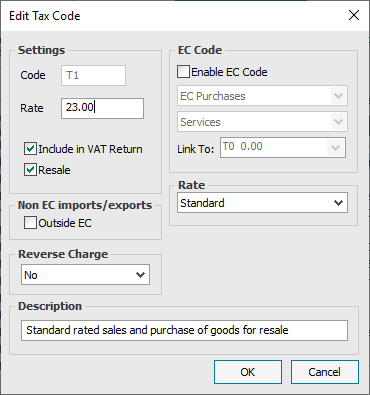

| T1 |

Sale |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchase |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

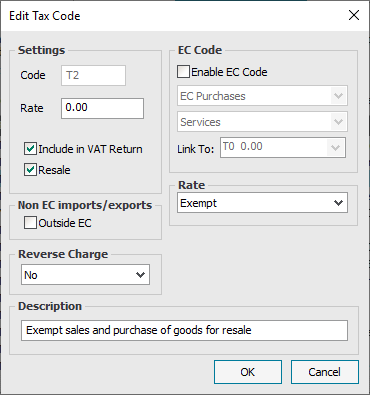

| T2 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

N/A |

| Purchase |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

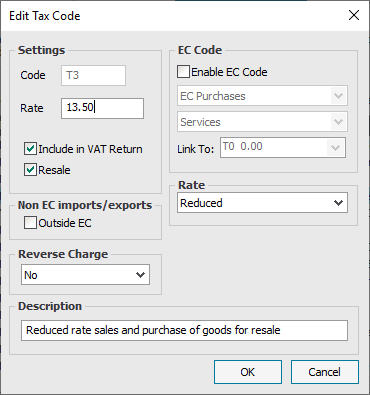

| T3 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchase |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

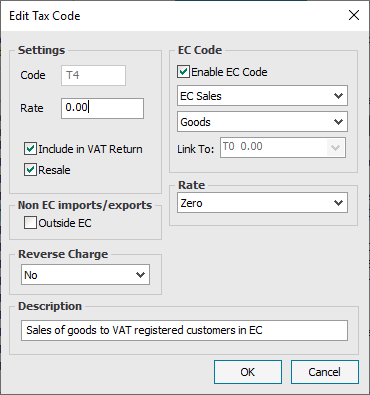

| T4 |

Sales |

Net |

Appears in box E1 and Total value of sales, excluding VAT box |

| VAT |

N/A |

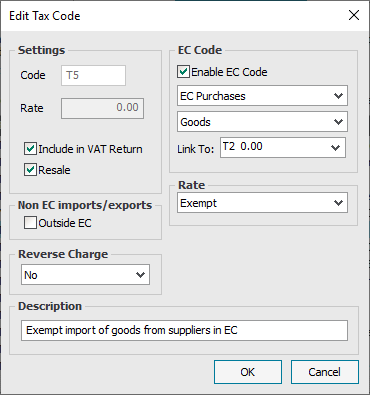

| T5 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

N/A |

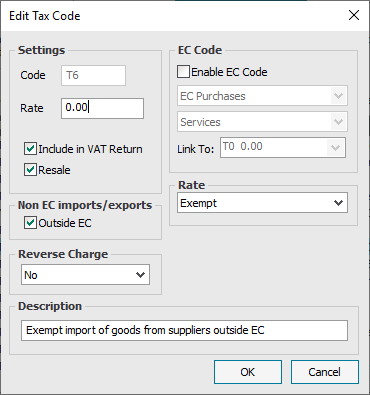

| T6 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

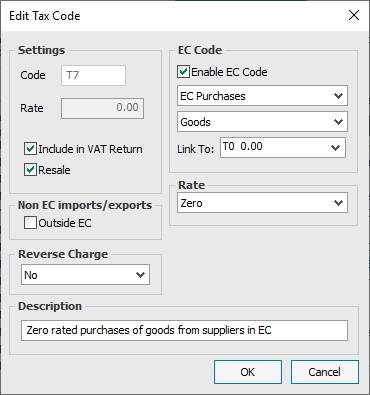

| T7 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

N/A |

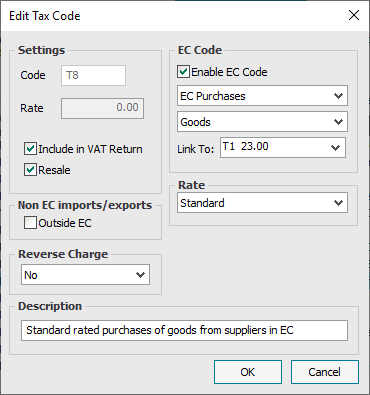

| T8 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

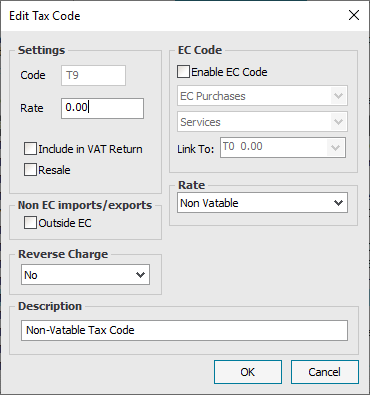

| T9 |

Non-vatable tax code, doesn’t appear on VAT return. |

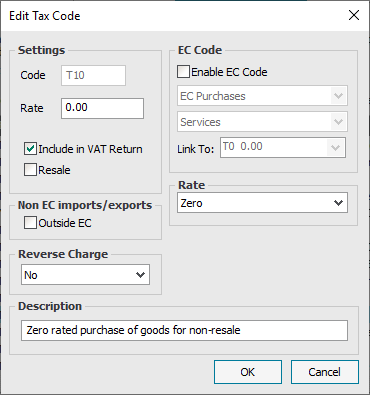

| T10 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

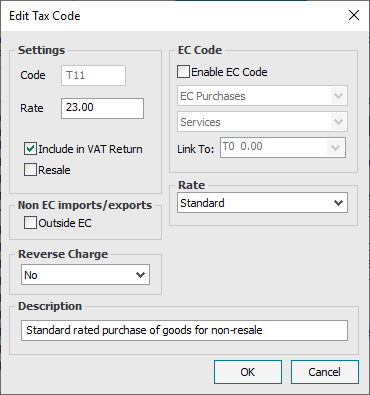

| T11 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

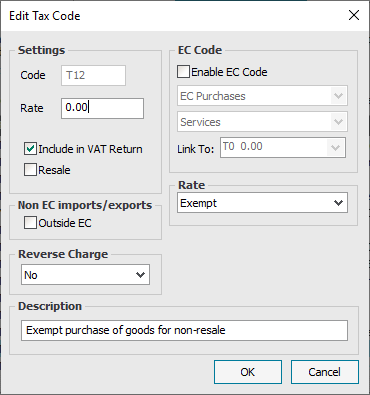

| T12 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

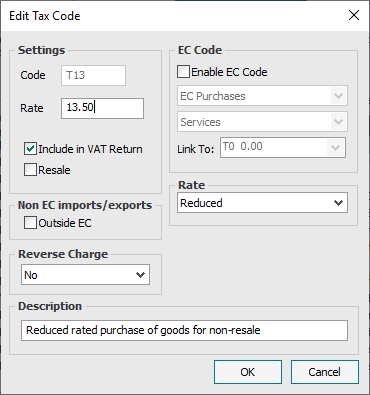

| T13 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

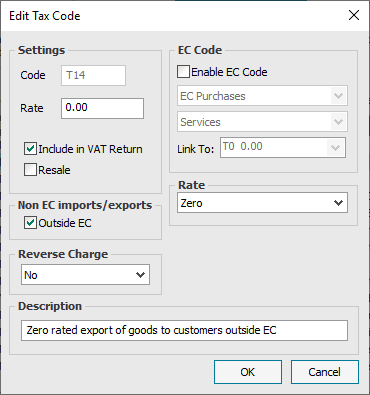

| T14 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

N/A |

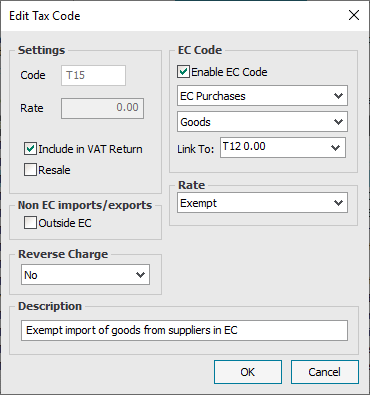

| T15 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

N/A |

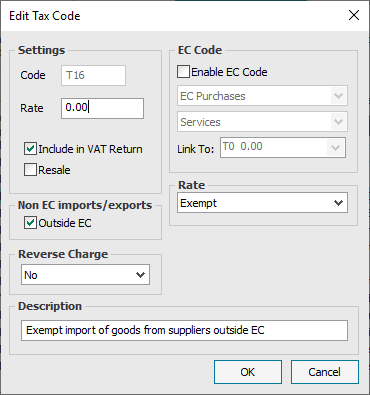

| T16 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

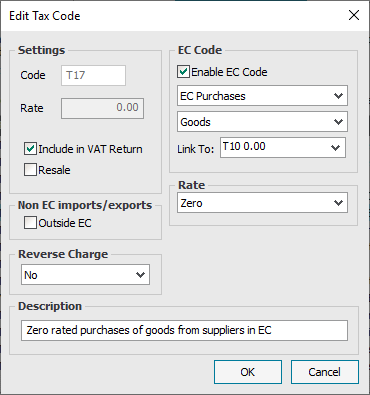

| T17 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

N/A |

| T18 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

| T19 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

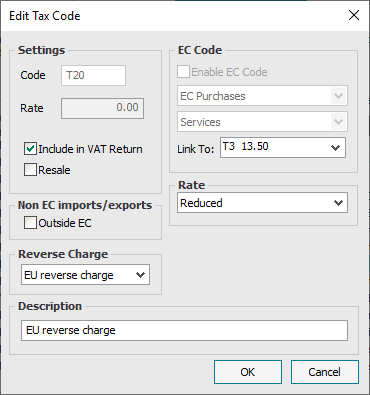

| T20 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box |

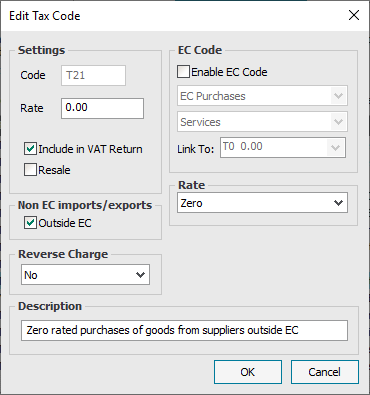

| T21 |

Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

N/A |

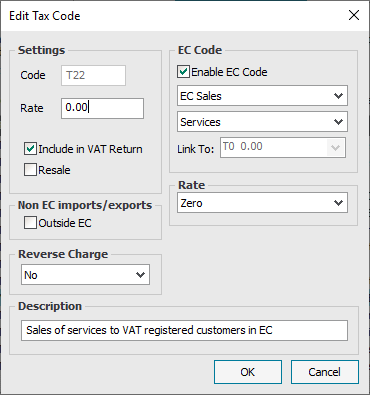

| T22 |

Sales |

Net |

Appears in box ES1 and Total value of sales, excluding VAT |

| VAT |

N/A |

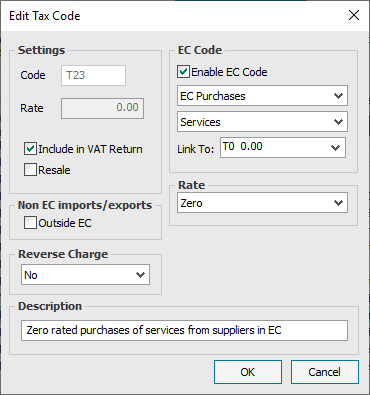

| T23 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

N/A |

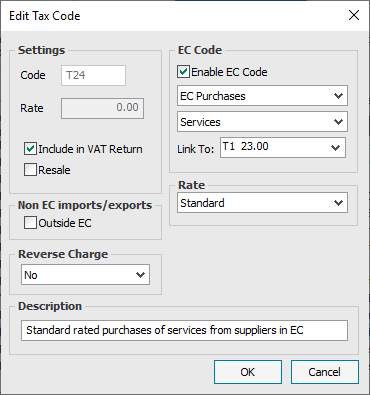

| T24 |

Purchases |

Net |

Appears in box ES2, Total value of sales, excluding VAT and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box |

| T25 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

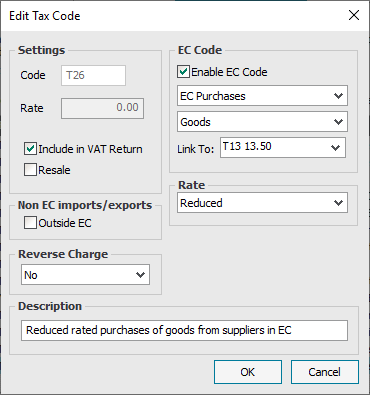

| T26 |

Purchases |

Net |

Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT |

Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

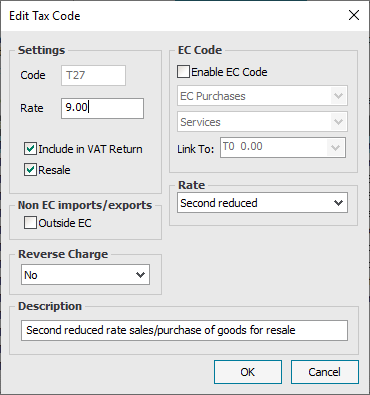

| T27 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

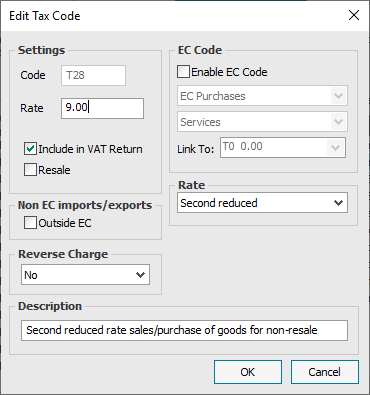

| T28 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

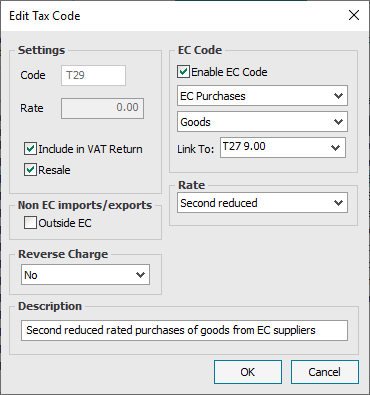

| T29 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |

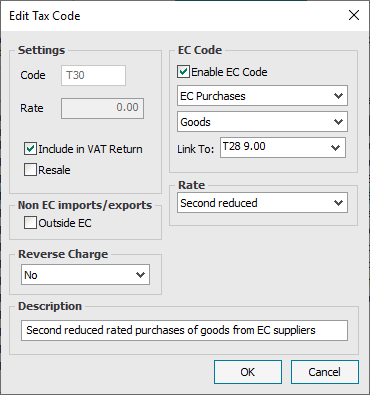

| T30 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |

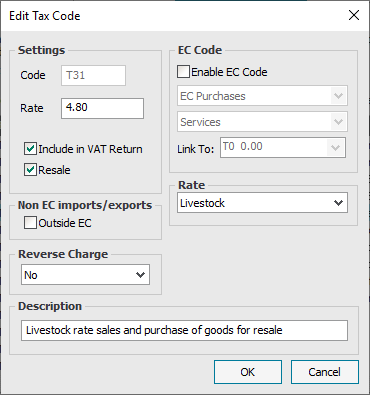

| T31 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

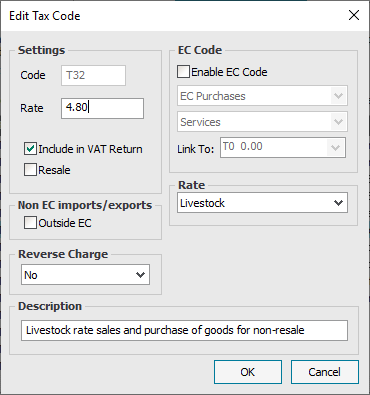

| T32 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

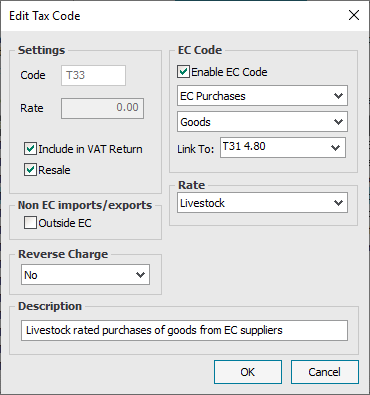

| T33 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |

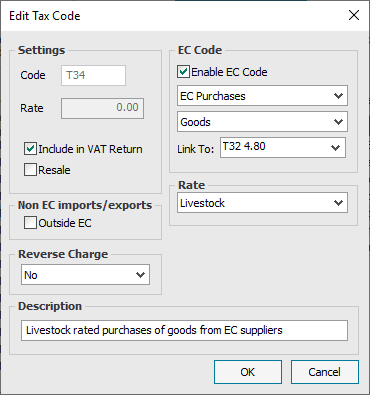

| T34 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |

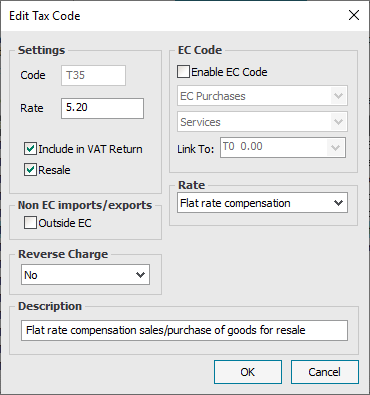

| T35 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

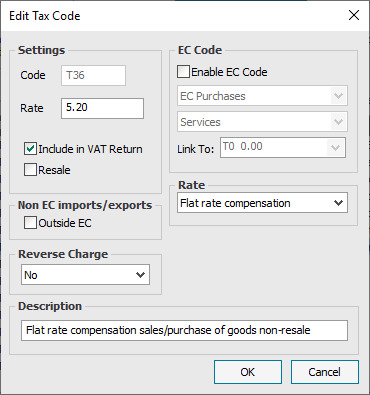

| T36 |

Sales |

Net |

Appears in Total value of sales, excluding VAT box |

| VAT |

Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases |

Net |

Appears in Total value of purchases, excluding VAT box |

| VAT |

Appears in box T2 |

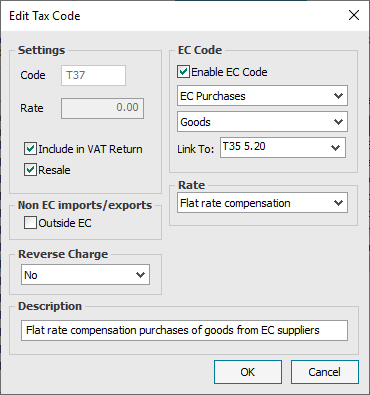

| T37 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |

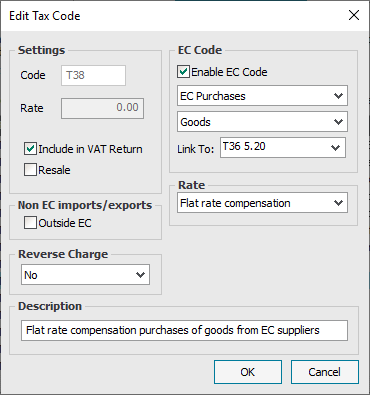

| T38 |

Purchases |

Net |

Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT |

Appears in boxes T2 and VAT due on intra-EU acquisitions |